Frequently Asked Questions

Frequently Asked Questions

Bitcoin services are provided to you solely by NYDIG Execution LLC (“NYDIG”) upon opening an account with NYDIG. Bitcoin trading involves risks, including possible loss of value. Not insured by the FDIC or SIPC. See Terms at sign up for detail, including eligibility, risks and licenses.

How do I set up my direct deposit with Quontic?

It’s easy! Log in to your online banking or mobile app, click Tools and select the Set up direct deposit option, and follow the prompts. You’ll search for your employer or payroll provider, securely log in and confirm your switch.

How do I set up my direct deposit with Quontic?

It’s easy! Log in to your online banking or mobile app, click Tools and select the Set up direct deposit option, and follow the prompts. You’ll search for your employer or payroll provider, securely log in and confirm your switch.

Where is my deposit?

Once the direct deposit switch is complete, it may take 1 – 3 pay cycles for the payroll system to fully update and for funds to flow into the new account. Some payroll systems are faster, some take longer.

Where is my deposit?

Once the direct deposit switch is complete, it may take 1 – 3 pay cycles for the payroll system to fully update and for funds to flow into the new account. Some payroll systems are faster, some take longer.

How do I cancel my direct deposit?

You will need to contact your HR department or access the payroll system directly to make this change.

*Please note that the direct deposit that was canceled will still show up in online banking because the tool does not keep track of the status.

How do I cancel my direct deposit?

You will need to contact your HR department or access the payroll system directly to make this change.

*Please note that the direct deposit that was canceled will still show up in online banking because the tool does not keep track of the status.

Is there a fee to use this tool?

Nope! This tool is completely free for our customers.

Is there a fee to use this tool?

Nope! This tool is completely free for our customers.

What if my 1098 Tax Form is incorrect?

If your loan was transferred to DMI or originated in June 2024 or later, please contact DMI directly at 1-855-300-7067 for assistance.

If your loan was sold to a provider other than DMI or paid off before June 1, 2024, please click here to complete the form and provide details about the discrepancies. Please allow up to 10 business days for review and resolution.

Why isn’t my joint account holder’s information on the 1098 Tax Form?

The IRS mandates that active loan account with payments be reported only under the name and Social Security Number of the Primary borrower, not the joint account holder(s).

Will I receive more than one 1098 Tax Form in a year?

You should receive a 1098 Tax Form from each company to which you paid reportable mortgage interest or points. You could receive more than one 1098 Tax Form if you refinanced the property during the year, or if servicing on the loan was transferred, and/or if you have multiple properties.

When will I receive my 1098 Tax Form in the mail?

Quontic will mail all 1098 forms by January 31st. Please allow 10–14 business days for delivery via standard postal service

Need to update your mailing address?

For updates to a PO BOX, please send us a message via Message Center through your Online Banking Portal or visiting our Contact Us Page.

- Using our Mobile Application

- Please log into your account through the Mobile Application.

- Click on More

- Click on Settings

- Click on Account Preferences

- Click on Contact

- Update your Mailing Address

- Please log into your account through the Mobile Application.

- Using our Desktop Online banking platform

- Please log into your account through the website.

- Click on Settings

- Click on Account Preferences

- Click on Contact

- Update your Mailing Address

- Please log into your account through the website.

How do I know if I will get a 1099 Tax Form?

If your account earned $10 or more in interest during the tax year, you will receive a 1099 form in mid-January, mailed to the address we have on file. You will need this form for tax filing purposes.

- Current Clients: Log into your Online Banking Platform and follow the instructions below to see if your active accounts have earned over $10.00 of interest for the calendar year.

- Click on AccountsClick on Tax InformationReview the Year to Date earn Interest under the Interest/ Dividend Column

- Inactive Clients: Please click here and we will verify whether you qualify for a 1099 form for the prior tax year.

Can a joint owner submit an electronic request copy of the Tax Form ?

No, only the primary account holder of the account is authorized to submit a request for an electronic copy of their Tax Form. The primary account holder must contact us or submit the request.

Why isn’t my joint account holder’s information on the 1099 Tax Form?

The IRS mandates that interest earned over $10.00 be reported only under the name and Social Security Number of the Primary Account Holder, not the joint account holder(s).

What is a Wire Transfer?

A wire transfer is an electronic transfer of funds via a network that is administered by banks and transfer service agencies around the world. Wire transfers are sent by one institution and received by another.

What type of Wire Transfer can I do at Quontic Bank?

Quontic allows the client to submit a Domestic or International Wire Transfer.

What are the fees for outgoing Wire Transfers?

These fees are subject to change, please visit our Schedule of Fees for the most recent fees of outgoing wires.

What are Quontic Wire cut-off times?

Wire Transfer initiated through the Quontic Online Banking platform:

- Foreign (US Dollars only) – cut-off time is at 4:00 PM EST

- Domestic – cut-off time is at 4:00 PM EST

Wire transfers initiated through Customer Support:

- Foreign – cut-off time is at 4:00 PM EST

- Domestic – cut-off time is at 4:00 PM EST

When are Wire Transfers processed?

Wire transfers can only be processed during business hours. Monday – Friday, excluding Holidays.

What if I submit a Wire Transfer via the Online Banking platform during the weekend?

Wire transfers submitted during the weekend or non-business hours will be processed during Quontic business hours.

What are the fees for incoming Wire Transfers?

There is no incoming fee for wire transfers.

How can I submit a Wire Transfer?

- Initiating a wire transfer via the Online Banking platform or through the Mobile App

- Contacting the Customer Support via Online Banking Platform Secure Message or email

How do I know if I am eligible for the Wire Transfer feature through the Online Banking platform?

- New Customer whose personal and liquid account relationship are less than 30 days will not be eligible for the Wire Transfer feature.

- Existing Customers whose personal and liquid account relationship are over than 30 days will be eligible for the Wire Transfer feature.

What type of accounts are eligible to be used for wire transfers?

Checking, Savings, and Money Market Accounts

What information do I need to provide my external foreign bank for an incoming International Wire?

Quontic Bank International Information:

Intermediary Bank Information:

Intermediary Beneficiary Bank Name: Atlantic Community Bankers Bank (ACBB)

Intermediary Beneficiary Bank Address: 225 Grandview Ave Suite 401, Camp Hill, PA 17011

Intermediary Beneficiary Bank Swift Code: NORHUS33

Final Bank Destination:

Beneficiary Bank Name: Quontic Bank

Beneficiary Bank Address: 3105 Broadway, Astoria, NY, 11106

Beneficiary Bank Phone Number: 800-908-6600

Beneficiary Account Number: Your Quontic Account Number

Beneficiary Bank Swift Code: NORHUS33

Beneficiary Bank Routing Number: 021473030

What information do I need to provide my external bank for an incoming Domestic Wire?

Quontic Bank Domestic Information:

Beneficiary Information:

Beneficiary Bank Name: Quontic Bank

Beneficiary Bank Address: 3105 Broadway, Astoria, NY, 11106

Beneficiary Bank Phone Number: 800-908-6600

Beneficiary Account Number: Your Quontic Account Number

Beneficiary Bank Routing Number: 021473030

Why is the mortgage interest shown on my Form 1098 different from last year?

The amount of interest you pay may change from year to year, usually because of a change in your interest rate or in the number of payments we received from you during the calendar year. For instance, you may have paid less interest if you modified your loan or received payment assistance through the Homeowners Assistance Fund (HAF). This may result in a lower amount of interest showing on your 1098 Tax Form.

Why does my Social Security number appear on the 1098 Tax Form?

The Internal Revenue Service (IRS) requires that 1098 Tax Forms be issued under the name and Social Security Number of the Primary borrower for tax reporting purposes.

Can I view my tax documents online?

If your loan was transferred to DMI or originated in June 2024 or later, you can view your 1098 Tax Form through the Mortgage Online Portal.

If your loan was sold to a provider other than DMI or paid off before June 1, 2024, you will receive your 1098 Tax Form via mail.

Whom can I contact with questions about my Quontic Mortgage 1098 Tax Form?

For assistance with your Quontic Mortgage 1098 Tax Form, please contact Mortgage Support at 1-855-300-7067. Our representatives are available Monday through Friday, from 8:00 AM to 5:00 PM EST.

What if I didn’t receive my tax document?

If your loan was transferred to DMI or originated in June 2024 or later, please contact DMI directly at 1-855-300-7067 for assistance. Please keep in mind that we cannot reproduce and/or duplicate 1098 statements until February 17, 2025.

If your loan was sold to a provider other than DMI or paid off before June 1, 2024, and have not received your Tax form by February 14th, please click here to request your tax form. Kindly allow up to 5 business days for completion.

Need to update your mailing address to receive your 1098 Tax Form?

To update your mailing address, please complete the “Change of Address or Phone Number” section on your monthly mortgage statement and mail it back to the address provided on the statement.

How do I know if I will get a 1098 Tax Form?

Mortgage clients who had an active mortgage account and made payment during the Tax year will be receiving a 1098 Tax Form.

Why does my Social Security number appear on the 1099 Tax Form?

The Internal Revenue Service (IRS) requires that 1099 Tax Forms be issued under the name and Social Security Number of the Primary Account Holder for tax reporting purposes.

Can my Tax Form be forwarded to a different mailing address set up with the United State Postal Service?

No, the Tax Form cannot be forwarded to an alternate address registered with the United States Postal Service. If you believe that we have an incorrect mailing address for you, please contact us through your online banking portal to update your contact information.

Can I view my Tax Documents Online?

At this time, you are unable to view the 1099 tax form in your Online Banking Portal.

Whom can I contact with questions about my Quontic 1099 tax forms?

Please send us a message via Message Center through your Online Banking Portal or visiting our Contact Us Page.

What if I didn’t receive my tax document?

If you have not received your 1099 Tax Form by February 14th, please click here to request an electronic copy of your mailed Tax Form if it’s been past the estimated time of arrival.

When will I receive my 1099 Tax Form in the mail?

Quontic will mail all 1099 forms by January 31st. Please allow 10–14 business days for delivery via standard postal service.

When do I have to submit my overnight check payment to ensure it will arrive on the next business day?

All payments must be submitted before 6:30 PM CT to be delivered by the next business day.

When do I have to submit my overnight check payment to ensure it will arrive on the next business day?

All payments must be submitted before 6:30 PM CT to be delivered by the next business day.

Is there a cost associated with an expedited payment?

There is a $25 fee associated with expedited payments.

Is there a cost associated with an expedited payment?

There is a $25 fee associated with expedited payments.

How can I view the filed bills?

You can view information on a filed bill by clicking Activity and then History.

How can I view the filed bills?

You can view information on a filed bill by clicking Activity and then History.

What file formats can I use to download data?

You can export any report into the CSV file format (for Microsoft Excel).

What file formats can I use to download data?

You can export any report into the CSV file format (for Microsoft Excel).

How will I know when a payment has been sent?

To verify that a payment has been sent, from your navigation links, click Transfer and Pay > Bill Pay > Activity > History and click into the transaction in question. At the top right there will be a proof of payment for payments that have been successfully processed.

How will I know when a payment has been sent?

To verify that a payment has been sent, from your navigation links, click Transfer and Pay > Bill Pay > Activity > History and click into the transaction in question. At the top right there will be a proof of payment for payments that have been successfully processed.

Can I track the delivery status of my overnight check payment?

To verify that a payment has been sent, from your navigation, click Transfer and Pay > Bill Pay > Activity > History and click into the transaction in question. At the top right there will be a proof of payment for payments that have been successfully processed.

Can I track the delivery status of my overnight check payment?

To verify that a payment has been sent, from your navigation, click Transfer and Pay > Bill Pay > Activity > History and click into the transaction in question. At the top right there will be a proof of payment for payments that have been successfully processed.

How can I download my billing history into my financial management software?

To download billing history, go to Transfer and Pay > Bill Pay > click on the ellipsis and then the download button.

How can I download my billing history into my financial management software?

To download billing history, go to Transfer and Pay > Bill Pay > click on the ellipsis and then the download button.

What happens if I do not have enough money in my account to cover a bill?

The funds must be present in your account at the time of creating the bill pay.

What happens if I do not have enough money in my account to cover a bill?

The funds must be present in your account at the time of creating the bill pay.

When are electronic payments issued?

If you authorize payment in advance, your EFT will be sent at 5 PM ET on the day you designated the payment to be sent. To have an EFT issued on the same day you authorize payment, you must authorize the transaction by 5 PM ET.

When are electronic payments issued?

If you authorize payment in advance, your EFT will be sent at 5 PM ET on the day you designated the payment to be sent. To have an EFT issued on the same day you authorize payment, you must authorize the transaction by 5 PM ET.

How do I print a copy of my bill?

From the payment details page, the customer has the ability to print or download proof of payment of a previous payment.

How do I print a copy of my bill?

From the payment details page, the customer has the ability to print or download proof of payment of a previous payment.

When are electronic funds transfers sent to my payees?

For payees who can accept electronic funds transfers (EFT), we recommend that you set the send date at least three business days in advance of the due date. If you authorize payment in advance, your EFT will be sent at 5:00 PM ET on the day you designated for the payment to be sent. To have an EFT issued on the same day you authorize payment, you must authorize the transaction by 5:00 PM ET. Please note that some EFT transactions may clear your bank account the same day they are issued. Be sure your account is funded in advance to avoid bounced payments.

When are electronic funds transfers sent to my payees?

For payees who can accept electronic funds transfers (EFT), we recommend that you set the send date at least three business days in advance of the due date. If you authorize payment in advance, your EFT will be sent at 5:00 PM ET on the day you designated for the payment to be sent. To have an EFT issued on the same day you authorize payment, you must authorize the transaction by 5:00 PM ET. Please note that some EFT transactions may clear your bank account the same day they are issued. Be sure your account is funded in advance to avoid bounced payments.

Will my deposited check be available in my transaction history?

Yes, you will see the check deposit in your transaction history.

Will my deposited check be available in my transaction history?

Yes, you will see the check deposit in your transaction history.

What happens if I don’t allow my device to “Remember Me?”

The “Remember Me” prompt enables your device to recall your Mobile Banking registration so that you are not presented with challenge questions every time you log in. If you select “Off” once prompted, you will be receive a one time passcode each time you log in to Online Banking.

What happens if I don’t allow my device to “Remember Me?”

The “Remember Me” prompt enables your device to recall your Mobile Banking registration so that you are not presented with challenge questions every time you log in. If you select “Off” once prompted, you will be receive a one time passcode each time you log in to Online Banking.

Want to make an external transfer through Online Banking?

New customers will not have access to the external transfer feature in online banking for the first 30 days. Once you have been a Quontic customer for 30 days, you will have access to the external transfer feature.

Want to make an external transfer through Online Banking?

New customers will not have access to the external transfer feature in online banking for the first 30 days. Once you have been a Quontic customer for 30 days, you will have access to the external transfer feature.

Can I link an external account instantly?

Yes, you can link an external account instantly by providing your online banking credentials for your external financial institution.

When will my deposit post to my account?

Deposits may be made with Mobile RDC at any time. If your deposit is approved before our daily cutoff time, your deposit will post to your account on the next business day. The daily cutoff time is 4:30 PM EST. Funds availability may be limited under certain conditions. Please refer to the Terms and Conditions document for more information.

When will my deposit post to my account?

Deposits may be made with Mobile RDC at any time. If your deposit is approved before our daily cutoff time, your deposit will post to your account on the next business day. The daily cutoff time is 4:30 PM EST. Funds availability may be limited under certain conditions. Please refer to the Terms and Conditions document for more information.

Who is eligible for Mobile Remote Deposit Capture (RDC)?

Customers who have a High Interest Checking account, Cash Rewards Checking account, High Yield Savings account, or Quontic Money Market account are eligible for Mobile RDC service.

Who is eligible for Mobile Remote Deposit Capture (RDC)?

Customers who have a High Interest Checking account, Cash Rewards Checking account, High Yield Savings account, or Quontic Money Market account are eligible for Mobile RDC service.

How do I add an external account?

To add an external account, please follow the steps below.

- Go to quontic.com and log in to your account. (Note: This will not work in the mobile app, so you must go to our website.)

- Select “Move Money” at the top of the page and click “Transfer”.

- Select “Manage Accounts” and click “Add Accounts”.

- Choose “External” and add your account information.

After the above steps are completed, Quontic Bank will deposit two test transactions into your external account. You should receive them in your external account within 1-2 business days. Once you do, please go back to quontic.com, log into your online banking profile and follow the instructions below:

- Select “Move Money” and click “Transfer”.

- Click “Manage Accounts”.

- Next to the external transfer account, click on “Verify”.

- Insert the amounts from the two deposits into the correct box.

Your external account is now added to your account.

Will the debit card associated with my Quontic account be a Visa or Mastercard?

A Mastercard Debit Card.

Will the debit card associated with my Quontic account be a Visa or Mastercard?

A Mastercard Debit Card.

Will my Personally Identifiable Information (PII) be compromised through this program?

Although there is always a risk to online accounts, both Quontic and NYDIG take your privacy and the security of your PII seriously. Both institutions have designed their systems and policies and procedures to prevent the compromise of any PII.

Will my Personally Identifiable Information (PII) be compromised through this program?

Although there is always a risk to online accounts, both Quontic and NYDIG take your privacy and the security of your PII seriously. Both institutions have designed their systems and policies and procedures to prevent the compromise of any PII.

Where can I get a copy of account disclosures?

Disclosures are available for review and print at the time of account opening. Should you require additional copies, please reach out to Customer Service.

Where can I get a copy of account disclosures?

Disclosures are available for review and print at the time of account opening. Should you require additional copies, please reach out to Customer Service.

Are there any fees if I use an ATM when traveling internationally?

Yes. When using an ATM while traveling internationally, our standard fee of $2.75 for using a non-Quontic ATM will apply.

Are there any fees if I use an ATM when traveling internationally?

Yes. When using an ATM while traveling internationally, our standard fee of $2.75 for using a non-Quontic ATM will apply.

What is the difference between Quontic’s Money Market account and High Yield Savings account?

| Money Market | High Yield Savings | |

|---|---|---|

| Product Description | The Money Market account is a savings account that offers a debit card and check-writing privileges. | A high-yield savings account allows our customers to earn higher interest than a regular savings account. |

| Current APY |

For current APY’s, view our Rate Sheet. |

|

| Minimum Deposit | $100.00 | $100.00 |

| ATM Access | Yes, customers can request a Debit Card | Yes, customers can request an ATM card |

| Check Writing | Yes, Options | Checks are not an option for our savings account |

| Fees | No Monthly or Overdraft fees *Other fees may apply |

No Monthly or Overdraft fees *Other fees may apply |

| FDIC Insurance | Available on eligible accounts | Available on eligible accounts |

| Zelle | Yes | Not available for HYS |

| Quontic Ring | Yes, customer can order a Quontic Ring | Not available for HYS |

| Mobile Deposit | Yes | Yes |

| Bill Pay | Yes | Not available for HYS |

What is the difference between Quontic’s Money Market account and High Yield Savings account?

| Money Market | High Yield Savings | |

|---|---|---|

| Product Description | The Money Market account is a savings account that offers a debit card and check-writing privileges. | A high-yield savings account allows our customers to earn higher interest than a regular savings account. |

| Current APY |

For current APY’s, view our Rate Sheet. |

|

| Minimum Deposit | $100.00 | $100.00 |

| ATM Access | Yes, customers can request a Debit Card | Yes, customers can request an ATM card |

| Check Writing | Yes, Options | Checks are not an option for our savings account |

| Fees | No Monthly or Overdraft fees *Other fees may apply |

No Monthly or Overdraft fees *Other fees may apply |

| FDIC Insurance | Available on eligible accounts | Available on eligible accounts |

| Zelle | Yes | Not available for HYS |

| Quontic Ring | Yes, customer can order a Quontic Ring | Not available for HYS |

| Mobile Deposit | Yes | Yes |

| Bill Pay | Yes | Not available for HYS |

Do I have pay mortgage insurance for a VA loan?

No, Private Mortgage Insurance isn’t required for a VA loan but there is an up-front funding fee.

Do I have pay mortgage insurance for a VA loan?

No, Private Mortgage Insurance isn’t required for a VA loan but there is an up-front funding fee.

How do I open a High Yield Savings account?

You can securely open your new account online in less than 3 minutes by visiting https://www.quontic.com/high-yield-savings/.

How do I open a High Yield Savings account?

You can securely open your new account online in less than 3 minutes by visiting https://www.quontic.com/high-yield-savings/.

What is Zelle®?

Zelle® is a fast, safe, and easy way to send money directly between almost any bank accounts in the U.S. – typically within minutes*. With just an email address or U.S. mobile phone number, you can send money to people you know and trust, regardless of where they bank*. Ask your recipient to enroll with Zelle® before you send them money – this will help them get your payment more quickly.

*A U.S. checking or savings account is required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees.

What is Zelle®?

Zelle® is a fast, safe, and easy way to send money directly between almost any bank accounts in the U.S. – typically within minutes*. With just an email address or U.S. mobile phone number, you can send money to people you know and trust, regardless of where they bank*. Ask your recipient to enroll with Zelle® before you send them money – this will help them get your payment more quickly.

*A U.S. checking or savings account is required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees.

How do I get started?

It’s easy. Zelle® is already available within our Quontic Mobile App! Check our app or sign-in online and follow a few simple steps to enroll with Zelle® today. We recommend you enroll before someone sends you money – this will help you get your first payment faster.

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient’s bank isn’t on the list, don’t worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

How do I get started?

It’s easy. Zelle® is already available within our Quontic Mobile App! Check our app or sign-in online and follow a few simple steps to enroll with Zelle® today. We recommend you enroll before someone sends you money – this will help you get your first payment faster.

You can find a full list of participating banks and credit unions live with Zelle® here.

If your recipient’s bank isn’t on the list, don’t worry! The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

Is my information secure?

Keeping your money and information safe is a top priority for Quontic. When you use Zelle® within our mobile app, your information is protected with the same technology we use to keep your bank account safe.

Is my information secure?

Keeping your money and information safe is a top priority for Quontic. When you use Zelle® within our mobile app, your information is protected with the same technology we use to keep your bank account safe.

What do I need to open a High Yield Savings account?

“To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, social security number to allow us to identify you. We may also ask for a valid government-issued ID. You must be a U.S. Citizen and 18 years or older to open an account.”

What do I need to open a High Yield Savings account?

“To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, social security number to allow us to identify you. We may also ask for a valid government-issued ID. You must be a U.S. Citizen and 18 years or older to open an account.”

What are the advantages of a VA loan?

VA loans offer little to no down payment, usually better terms and interest rates, no need for Private Mortgage Insurance (PMI) or mortgage insurance premiums, usually better closing costs, and no penalty fee if you pay the loan off early.

What are the advantages of a VA loan?

VA loans offer little to no down payment, usually better terms and interest rates, no need for Private Mortgage Insurance (PMI) or mortgage insurance premiums, usually better closing costs, and no penalty fee if you pay the loan off early.

What are the requirements for VA loans?

VA loan requirements include, but are not limited to, providing a VA home loan Certificate of Eligibility (COE), meeting the standards for credit and income and living in the home you’re buying with the loan.

What are the requirements for VA loans?

VA loan requirements include, but are not limited to, providing a VA home loan Certificate of Eligibility (COE), meeting the standards for credit and income and living in the home you’re buying with the loan.

How much of a down payment do I need for a VA loan?

Depending on the applicant, a VA purchase loan may require little to no down payment.

How much of a down payment do I need for a VA loan?

Depending on the applicant, a VA purchase loan may require little to no down payment.

How much of a down payment do I need for an FHA loan?

Potential homebuyers can get an FHA home loan with as little as a 3.5% down payment.

How much of a down payment do I need for an FHA loan?

Potential homebuyers can get an FHA home loan with as little as a 3.5% down payment.

Is an FHA loan a good option for first-time homebuyers?

FHA loans are extremely popular with first time homebuyers who may not have saved enough for a large down payment.

Is an FHA loan a good option for first-time homebuyers?

FHA loans are extremely popular with first time homebuyers who may not have saved enough for a large down payment.

Who can qualify for an FHA loan?

FHA home loans may be for any financially qualified borrower. Some of the important factors include your credit history and FICO scores in order to secure the minimum down payment of 3.5%.

Who can qualify for an FHA loan?

FHA home loans may be for any financially qualified borrower. Some of the important factors include your credit history and FICO scores in order to secure the minimum down payment of 3.5%.

What are the advantages of a mortgage refinance?

There are many advantages to mortgage refinancing. Borrowers are able to take advantage of their home equity, get a different type of loan, secure a lower interest rate, or even lower their monthly payments. Additionally, it is a great way to help consolidate any outstanding debt, upgrade your kitchen or bathroom, or shorten your 30-year mortgage substantially. Whether you’re looking to eliminate PMI, pay less money each month on your mortgage payment or secure a fixed-rate mortgage, there are endless advantages to getting a refi. In general, homeowners use refinancing as a way to better their financial situation.

What are the advantages of a mortgage refinance?

There are many advantages to mortgage refinancing. Borrowers are able to take advantage of their home equity, get a different type of loan, secure a lower interest rate, or even lower their monthly payments. Additionally, it is a great way to help consolidate any outstanding debt, upgrade your kitchen or bathroom, or shorten your 30-year mortgage substantially. Whether you’re looking to eliminate PMI, pay less money each month on your mortgage payment or secure a fixed-rate mortgage, there are endless advantages to getting a refi. In general, homeowners use refinancing as a way to better their financial situation.

What’s a mortgage refinance?

A mortgage refinance happens when homeowners seek out a new home loan in order to replace their current loan. The reasons why vary from homeowner to homeowner, but traditionally the end goal is to save money on your monthly mortgage payment.

What’s a mortgage refinance?

A mortgage refinance happens when homeowners seek out a new home loan in order to replace their current loan. The reasons why vary from homeowner to homeowner, but traditionally the end goal is to save money on your monthly mortgage payment.

Why should I get my mortgage through Quontic Bank?

At Quontic, you’re more than just a loan application. We value all our customers’ diverse situations and embrace them with specialized mortgages made to fit their needs. Plus, in addition to being registered to lend in all 50 states, we offer a diverse and multi-lingual sales team, an experienced Mortgage Specialist at every step and convenient and helpful customer service.

Why should I get my mortgage through Quontic Bank?

At Quontic, you’re more than just a loan application. We value all our customers’ diverse situations and embrace them with specialized mortgages made to fit their needs. Plus, in addition to being registered to lend in all 50 states, we offer a diverse and multi-lingual sales team, an experienced Mortgage Specialist at every step and convenient and helpful customer service.

What are the current mortgage rates?

Mortgage rates can change every day. For the most current rates, please provide your contact information and we’ll have a mortgage specialist contact you.

What are the current mortgage rates?

Mortgage rates can change every day. For the most current rates, please provide your contact information and we’ll have a mortgage specialist contact you.

Why is it important to get pre-qualified for a mortgage?

Getting pre-qualified for a mortgage helps you understand how much home you can afford and shows that you are a serious buyer. It also helps you find a lender that can work with you to select the right home loan with an interest rate that fits your needs.

Why is it important to get pre-qualified for a mortgage?

Getting pre-qualified for a mortgage helps you understand how much home you can afford and shows that you are a serious buyer. It also helps you find a lender that can work with you to select the right home loan with an interest rate that fits your needs.

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance, or PMI, is an added insurance policy for homeowners who have a down payment that is less than 20%. PMI protects the lender if the borrower is unable to pay their mortgage. This insurance is not forever. It will either end automatically when a mortgage’s principal balance reaches 78% of the original appraised value of the home or the borrower can ask the lender for a new appraisal to validate that they have built at least 20% equity in their home.

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance, or PMI, is an added insurance policy for homeowners who have a down payment that is less than 20%. PMI protects the lender if the borrower is unable to pay their mortgage. This insurance is not forever. It will either end automatically when a mortgage’s principal balance reaches 78% of the original appraised value of the home or the borrower can ask the lender for a new appraisal to validate that they have built at least 20% equity in their home.

How much home can I afford?

Many experts recommend that your housing costs – including mortgage, taxes and insurance – should be no more than 28% of your monthly income. However, this rule of thumb may not work for everyone. To figure out how much you can afford to spend on a home, consider your household income, monthly debts and the amount you plan to use for a down payment.

How much home can I afford?

Many experts recommend that your housing costs – including mortgage, taxes and insurance – should be no more than 28% of your monthly income. However, this rule of thumb may not work for everyone. To figure out how much you can afford to spend on a home, consider your household income, monthly debts and the amount you plan to use for a down payment.

What’s the difference between FHA and Conventional loans?

FHA loans and Conventional loans differ on several factors including lower down payment and the credit score requirements to qualify. Conventional loans typically require higher FICO scores and a minimum 20% down payment.

What’s the difference between FHA and Conventional loans?

FHA loans and Conventional loans differ on several factors including lower down payment and the credit score requirements to qualify. Conventional loans typically require higher FICO scores and a minimum 20% down payment.

What is an FHA Mortgage?

FHA loans are known to be a flexible lending option. Suitable for first-time buyers, FHA loans have more flexible qualifications than conventional loans.

What is an FHA Mortgage?

FHA loans are known to be a flexible lending option. Suitable for first-time buyers, FHA loans have more flexible qualifications than conventional loans.

How is the interest on my Money Market Account calculated?

Interest is compounded daily based on your posted account daily balance.

How is the interest on my Money Market Account calculated?

Interest is compounded daily based on your posted account daily balance.

Does the Money Market Account come with a Debit Card?

Yes, you can get a debit card for your Quontic money market account.

Does the Money Market Account come with a Debit Card?

Yes, you can get a debit card for your Quontic money market account.

How do I open a Money Market Account?

You can securely open your new Money Market Account online in less than 3 minutes by visiting https://www.quontic.com/money-market-account/.

How do I open a Money Market Account?

You can securely open your new Money Market Account online in less than 3 minutes by visiting https://www.quontic.com/money-market-account/.

Is there a minimum opening deposit?

Yes, the minimum amount to open a Money Market Account is $100.

Is there a minimum opening deposit?

Yes, the minimum amount to open a Money Market Account is $100.

When is interest paid?

Interest is credited to your account every month at the end of your statement cycle.

When is interest paid?

Interest is credited to your account every month at the end of your statement cycle.

How do I fund my account?

To make your initial deposit, you can transfer money from your existing Quontic account, you can transfer money from an external account via ACH, or using Plaid’s technology. Please ensure that you have sufficient funds available to be transferred.

How do I fund my account?

To make your initial deposit, you can transfer money from your existing Quontic account, you can transfer money from an external account via ACH, or using Plaid’s technology. Please ensure that you have sufficient funds available to be transferred.

Is there a minimum opening deposit?

Yes, the minimum amount to open a High Yield Savings account is $100.

Is there a minimum opening deposit?

Yes, the minimum amount to open a High Yield Savings account is $100.

How is the interest on my High Yield Savings account calculated?

Interest is compounded daily based on your posted account balance.

How is the interest on my High Yield Savings account calculated?

Interest is compounded daily based on your posted account balance.

What perks come with being a Quontic member?

- 90,000+ surcharge free ATMs

- Automatic bill pay (Eligible accounts only)

- Mobile check deposit

- Free Mastercard Debit Card

- Load your card to your digital wallet for Apple Pay, Google Pay and Samsung Pay

- Mastercard Zero Liability Protection and ID Theft Protection

- Mastercard Airport Concierge

- 24/7 Access via online and mobile banking

- 0 monthly service fees

What perks come with being a Quontic member?

- 90,000+ surcharge free ATMs

- Automatic bill pay (Eligible accounts only)

- Mobile check deposit

- Free Mastercard Debit Card

- Load your card to your digital wallet for Apple Pay, Google Pay and Samsung Pay

- Mastercard Zero Liability Protection and ID Theft Protection

- Mastercard Airport Concierge

- 24/7 Access via online and mobile banking

- 0 monthly service fees

Can I add money to my account?

Yes! You can easily add money to your account through remote check deposit via our convenient Mobile App, by setting up direct deposit from your work, by mailing a check, depositing money via ACH, or by wire.

Can I add money to my account?

Yes! You can easily add money to your account through remote check deposit via our convenient Mobile App, by setting up direct deposit from your work, by mailing a check, depositing money via ACH, or by wire.

Can I take money out of my account?

Yes, you can spend your money like any other checking accounts. You will be able to sign up for Online Banking, Mobile Banking and be provided with a Quontic Debit Card.

Can I take money out of my account?

Yes, you can spend your money like any other checking accounts. You will be able to sign up for Online Banking, Mobile Banking and be provided with a Quontic Debit Card.

When do I get my reward?

Your cash back reward will be paid and deposited into your checking account at the beginning of each new statement cycle.

When do I get my reward?

Your cash back reward will be paid and deposited into your checking account at the beginning of each new statement cycle.

How do I get cash back?

Just use your Quontic Debit Card for everyday Qualifying Point of Sale (POS) purchases! Qualifying point of sale (POS) debit card transactions shall receive 1.00% cash back that post and settle to the account each statement cycle up to an aggregate total $50 per statement cycle. The following activities are not considered POS debit card transactions and do not count toward earning rewards: : Intentionally creating spending for the sole purpose of generating rewards at little or no cost violates the intent of Quontic’s Cash Reward Checking, and subjects the account to closure. ATM – processed transactions; transfers between accounts; purchases made with debit cards not issued by our bank; cash over portions of point-of-sale transactions; Peer-to-Peer (P2P) payments (such as Apple Pay Cash*); loan payments or account funding made with your debit card and purchases made using third-party payment accounts. Quontic may close the account for any reason including manufactured spending. Transactions may take one or more business days from the date the transaction was made to post and settle to an account.

How do I get cash back?

Just use your Quontic Debit Card for everyday Qualifying Point of Sale (POS) purchases! Qualifying point of sale (POS) debit card transactions shall receive 1.00% cash back that post and settle to the account each statement cycle up to an aggregate total $50 per statement cycle. The following activities are not considered POS debit card transactions and do not count toward earning rewards: : Intentionally creating spending for the sole purpose of generating rewards at little or no cost violates the intent of Quontic’s Cash Reward Checking, and subjects the account to closure. ATM – processed transactions; transfers between accounts; purchases made with debit cards not issued by our bank; cash over portions of point-of-sale transactions; Peer-to-Peer (P2P) payments (such as Apple Pay Cash*); loan payments or account funding made with your debit card and purchases made using third-party payment accounts. Quontic may close the account for any reason including manufactured spending. Transactions may take one or more business days from the date the transaction was made to post and settle to an account.

Is there a minimum to open a Cash Rewards Checking Account?

You can open an account with as little as $100.

Is there a minimum to open a Cash Rewards Checking Account?

You can open an account with as little as $100.

How do I open a Cash Rewards Checking Account?

You can securely open your new High Interest Checking account online in less than 3 minutes by visiting https://www.quontic.com/cash-rewards-checking/.

How do I open a Cash Rewards Checking Account?

You can securely open your new High Interest Checking account online in less than 3 minutes by visiting https://www.quontic.com/cash-rewards-checking/.

Are there ATM Fees?

You won’t have to pay ATM fees when you use your Quontic Debit Card at any AllPoint® Network ATMs, MoneyPass® Network ATMs, SUM® program ATMs, or Citibank® ATMs located in Target, Speedway, Walgreens, CVS, Kroger, Safeway, Winn Dixie, and Circle K. Check out our ATM locator.

Are there ATM Fees?

You won’t have to pay ATM fees when you use your Quontic Debit Card at any AllPoint® Network ATMs, MoneyPass® Network ATMs, SUM® program ATMs, or Citibank® ATMs located in Target, Speedway, Walgreens, CVS, Kroger, Safeway, Winn Dixie, and Circle K. Check out our ATM locator.

In case I need cash, what ATMs can I use?

We have a network of over 90,000 Surcharge free at any participating AllPoint® Network ATMs, MoneyPass® Network ATMs, SUM® program ATMs, or Citibank® ATMs located in Target, Speedway, Walgreens, CVS, Kroger, Safeway, Winn Dixie, and Circle K. Check out our ATM Locator.

In case I need cash, what ATMs can I use?

We have a network of over 90,000 Surcharge free at any participating AllPoint® Network ATMs, MoneyPass® Network ATMs, SUM® program ATMs, or Citibank® ATMs located in Target, Speedway, Walgreens, CVS, Kroger, Safeway, Winn Dixie, and Circle K. Check out our ATM Locator.

What should Zelle® be used for?

Zelle® is a great way to send money to family, friends, and people you are familiar with, such as your personal trainer, babysitter, or neighbor. If you don’t know the person or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), we recommend you do not use Zelle® for these types of transactions. These transactions are potentially high risk.

Zelle® should only be used to send money to friends, family, and others you trust. Zelle® does not offer a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected. Quontic does not offer a protection program for any authorized payments made with Zelle®.

What should Zelle® be used for?

Zelle® is a great way to send money to family, friends, and people you are familiar with, such as your personal trainer, babysitter, or neighbor. If you don’t know the person or aren’t sure you will get what you paid for (for example, items bought from an online bidding or sales site), we recommend you do not use Zelle® for these types of transactions. These transactions are potentially high risk.

Zelle® should only be used to send money to friends, family, and others you trust. Zelle® does not offer a protection program for any authorized payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected. Quontic does not offer a protection program for any authorized payments made with Zelle®.

Can I change or cancel a Zelle® payment once I have sent it?

Payment amounts made with Zelle® cannot be changed once the payment has been sent. You can only cancel a payment if the recipient hasn’t yet enrolled with Zelle®, in which case you can access Zelle® in the Quontic mobile app, select the payment you want to cancel and then select “Cancel This Payment”. If your recipient has already enrolled with Zelle®, the money is sent directly to your recipient’s bank account and cannot be cancelled.

If you aren’t able to get your money back, call our customer support team at 1-800-908-6600 so we can help you. We recommend you don’t use Zelle® to send money to people you do not know. If you sent money to the wrong person and the payment cannot be cancelled, we recommend contacting the recipient and requesting the money back. If you have requested money from someone and they have already sent it to you, you will not be able to cancel the request.

Can I change or cancel a Zelle® payment once I have sent it?

Payment amounts made with Zelle® cannot be changed once the payment has been sent. You can only cancel a payment if the recipient hasn’t yet enrolled with Zelle®, in which case you can access Zelle® in the Quontic mobile app, select the payment you want to cancel and then select “Cancel This Payment”. If your recipient has already enrolled with Zelle®, the money is sent directly to your recipient’s bank account and cannot be cancelled.

If you aren’t able to get your money back, call our customer support team at 1-800-908-6600 so we can help you. We recommend you don’t use Zelle® to send money to people you do not know. If you sent money to the wrong person and the payment cannot be cancelled, we recommend contacting the recipient and requesting the money back. If you have requested money from someone and they have already sent it to you, you will not be able to cancel the request.

Is there a limit to how much money I can send with Zelle®?

Yes, the maximum transaction limit is $500 and maximum allowed for total transactions per day is $1,000.

Is there a limit to how much money I can send with Zelle®?

Yes, the maximum transaction limit is $500 and maximum allowed for total transactions per day is $1,000.

How do I use Zelle®?

You can send, request, or receive money with Zelle®. To get started, log into our Quontic mobile app and select “Send Money with Zelle®”. Enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it, accept terms and conditions, and you’re finished.

To send money using Zelle®, simply select someone from your mobile device’s contacts (or add a trusted recipient’s email address or U.S. mobile phone number), add the amount you’d like to send, and an optional memo, review, then hit “Send”. In most cases, the money is available to your recipient in minutes.*

To request money using Zelle®, choose either “Request”, if there is just one recipient, or “Split”, if there are multiple recipients, select the individual(s) from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request”**. To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®.

*U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees.

**Payments requested to persons not already enrolled with Zelle® must be sent to an email address.

How do I use Zelle®?

You can send, request, or receive money with Zelle®. To get started, log into our Quontic mobile app and select “Send Money with Zelle®”. Enter your email address or U.S. mobile phone number, receive a one-time verification code, enter it, accept terms and conditions, and you’re finished.

To send money using Zelle®, simply select someone from your mobile device’s contacts (or add a trusted recipient’s email address or U.S. mobile phone number), add the amount you’d like to send, and an optional memo, review, then hit “Send”. In most cases, the money is available to your recipient in minutes.*

To request money using Zelle®, choose either “Request”, if there is just one recipient, or “Split”, if there are multiple recipients, select the individual(s) from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request”**. To receive money, just share your enrolled email address or U.S. mobile phone number with a friend and ask them to send you money with Zelle®.

*U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees.

**Payments requested to persons not already enrolled with Zelle® must be sent to an email address.

What if I want to send money to someone whose bank or credit union doesn’t offer Zelle®?

You can find a full list of participating banks and credit unions live with Zelle® here. If your recipient’s bank isn’t on the list, don’t worry! The network of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS. To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

What if I want to send money to someone whose bank or credit union doesn’t offer Zelle®?

You can find a full list of participating banks and credit unions live with Zelle® here. If your recipient’s bank isn’t on the list, don’t worry! The network of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS. To enroll with the Zelle® app, your recipient will enter their basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

What is an external transfer?

Quontic may make it possible for a customer to initiate and conduct external transfers through Quontic online banking with limitations. A transaction is considered an outbound external transfer if funds are transferred out of your Quontic Bank accounts into your Non-Quontic Bank Accounts. Once you have access to external transfers, you can link your non-Quontic Bank accounts by inputting your account and routing number, and verifying two micro deposits.

What is an external transfer?

Quontic may make it possible for a customer to initiate and conduct external transfers through Quontic online banking with limitations. A transaction is considered an outbound external transfer if funds are transferred out of your Quontic Bank accounts into your Non-Quontic Bank Accounts. Once you have access to external transfers, you can link your non-Quontic Bank accounts by inputting your account and routing number, and verifying two micro deposits.

I have been a Quontic customer for less than 30 days. How can I get access to my funds?

When you have successfully opened an account at Quontic, you can opt in to receive a debit card or ATM card, depending on the product you selected during account opening. You will also have access to person to person payments through Zelle in our mobile app. Lastly, if you initiate the transfer from your other banking institution, whether you are pulling funds from your Quontic account or sending to it, our limits do not apply. Once you have been a customer at Quontic for 30 days or more, you will be given access to the external transfer feature.

I have been a Quontic customer for less than 30 days. How can I get access to my funds?

When you have successfully opened an account at Quontic, you can opt in to receive a debit card or ATM card, depending on the product you selected during account opening. You will also have access to person to person payments through Zelle in our mobile app. Lastly, if you initiate the transfer from your other banking institution, whether you are pulling funds from your Quontic account or sending to it, our limits do not apply. Once you have been a customer at Quontic for 30 days or more, you will be given access to the external transfer feature.

What if I want to transfer more than Quontic’s limits allows?

These transfer limits only apply if the transfer is initiated through Quontic’s online banking. Our external transfer limits do not apply if the transfer is initiated through your other banking institution.

What if I want to transfer more than Quontic’s limits allows?

These transfer limits only apply if the transfer is initiated through Quontic’s online banking. Our external transfer limits do not apply if the transfer is initiated through your other banking institution.

What are my daily and monthly external transfer limits at Quontic?

Limits range from $2,000 daily to $10,000 monthly, depending on user levels and cadence. You can see more specific information about your limits in online and mobile banking under Transfer and Pay > Transfers and click the limits hyperlink towards the bottom of the page.

What are my daily and monthly external transfer limits at Quontic?

Limits range from $2,000 daily to $10,000 monthly, depending on user levels and cadence. You can see more specific information about your limits in online and mobile banking under Transfer and Pay > Transfers and click the limits hyperlink towards the bottom of the page.

Do I have to have a Quontic Bank account to get a Ring?

Yes- you must have a Quontic Bank Checking account to order a ring.

How strong is the Ring?

Your Ring has been designed to be resistant to scratching and proven to be more resilient than certain precious metals of equivalent thickness. It’s still precious, so please treat it as such.

How often does it need to be charged?

Everyone likes good news right? Your Ring NEVER needs to be charged”¦. EVER! You can wear your Ring all day and all night, so it’s always to hand to make those important payments even when other devices have run out of battery.

Can I wear it in the shower or when swimming?

The Ring is waterproof to 50m, so perfectly able to withstand swimming, bathing or washing up.

Can my Ring be associated with my Quontic Bank Account if I already have a debit card associated with that account?

Yes. You can use your Ring and your Debit Card with the same account.

Want to make an external transfer through Online Banking?

New customers will receive access to the external transfer feature in online banking when their account has been open for 30 days. If you are still unable to set up external transfers after 31 days, please call 800-908-6600, or email us at [email protected] to request access.

Want to make an external transfer through Online Banking?

New customers will receive access to the external transfer feature in online banking when their account has been open for 30 days. If you are still unable to set up external transfers after 31 days, please call 800-908-6600, or email us at [email protected] to request access.

How do I add a beneficiary to my account?

You can sign onto your Online Banking Account and click Settings and then Message Center. You will then click Compose and select ‘Beneficiary Questions’ as the subject line.

What are the technical requirements for Online Banking?

Quontic’s official end user browser support policy is as follows:

- Google Chrome: Latest two versions

- Firefox: Latest two versions

- Microsoft Edge: Latest two versions

- Safari: Last two major versions

Quontic supports Windows and Apple macOS computing platforms as well as Android and iOS mobile platforms.

Quontic’s platform support is as follows:

- Windows: Versions that are still supported by Microsoft and support a browser listed above

- OSX: Versions that are still supported by Apple and support a browser listed above

- Android: Current and prior two major versions

- iOS: Current and prior two major versions

What if I don’t know my ring size?

During the ring ordering process, you will be asked if you’d like to order a free ring sizing kit. We highly recommend that you choose to order a sizing kit before submitting your ring size. Ring sizes and ring sizers can vary across the industry. Sizing kits are free of charge and help to ensure you get the perfect fit

I ordered a ring sizing kit, now what?

Once you receive your sizing kit in the mail, check your inbox for an email you received when you submitted your request for a ring sizer from [email protected]. It contains a unique link to activate complete your ring order.

I’ve ordered my Quontic Payment Ring, now what?

Once you receive your ring in the mail, check your inbox for an email you received when you submitted your ring order from [email protected]. It contains a unique link to activate your ring. You will need the activation sticker located on the plastic ring box wrapper. If you have an issue with activating your ring, please call 1-800-908-6600.

I’m trying to activate my ring, and it says I need my Activation Code. Where can I find that?

You can locate your activation code on the sticker that is located on the plastic ring box wrapper. If you have an issue with activating your ring, please call 1-800-908-6600.

Will I have a PIN Associated with my ring?

Yes, once you activate your ring you can create a four digit PIN. You may also use the same PIN for your Quontic debit card once it is activated.

How to physically use your Ring

It’s important to use the correct hand gesture when using your Ring at a compatible contactless terminal.

For the terminal to detect your Ring reliably, it is best to use a ‘knocking’ gesture with your hand. Simply approach the terminal as if you were going to knock on it and hold your fist in position until you see the confirmation of payment or hear the confirmation beep.

Here’s a quick visual guide on the correct hand gesture to use when making payments with your Ring.

What if my Ring doesn’t fit?

If your ring does not fit, please contact customer service at 1-800-908-6600. If the ring fits on another finger than the original finger you intended, we suggest trying it out to avoid the returning process.

Where can I use my Ring?

Rings can be used at any payment terminal that accepts contactless payments. Look for the contactless symbol. Please note that there may be instances where a terminal is unable to accept the Ring as a payment device – just like some contactless terminals can’t read a debit card and ask that you use chip instead.

Does my Ring have a card number associated with it?

The ring has a card number in the system but is not shared with the customer. If you need to make an online purchase that requires a full card number, we suggest you use your Quontic Bank debit card.

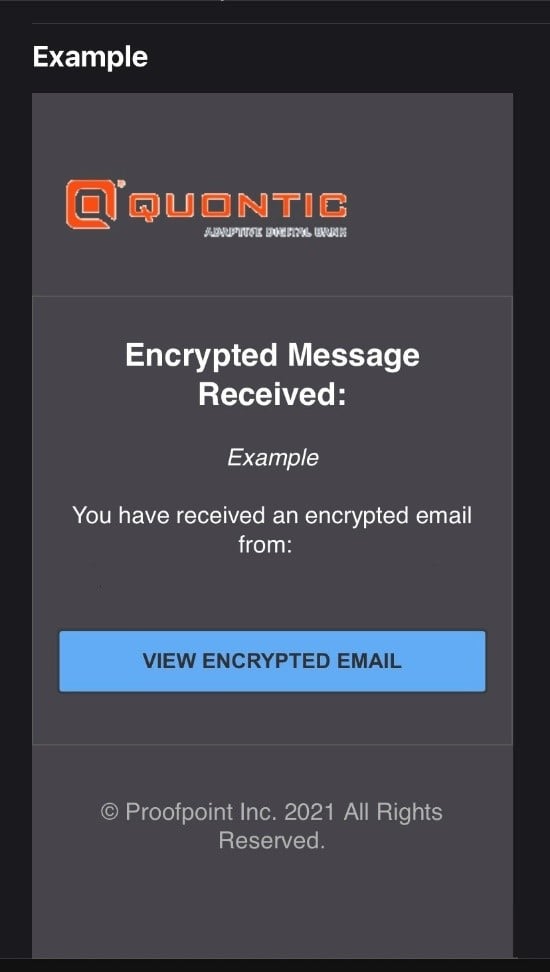

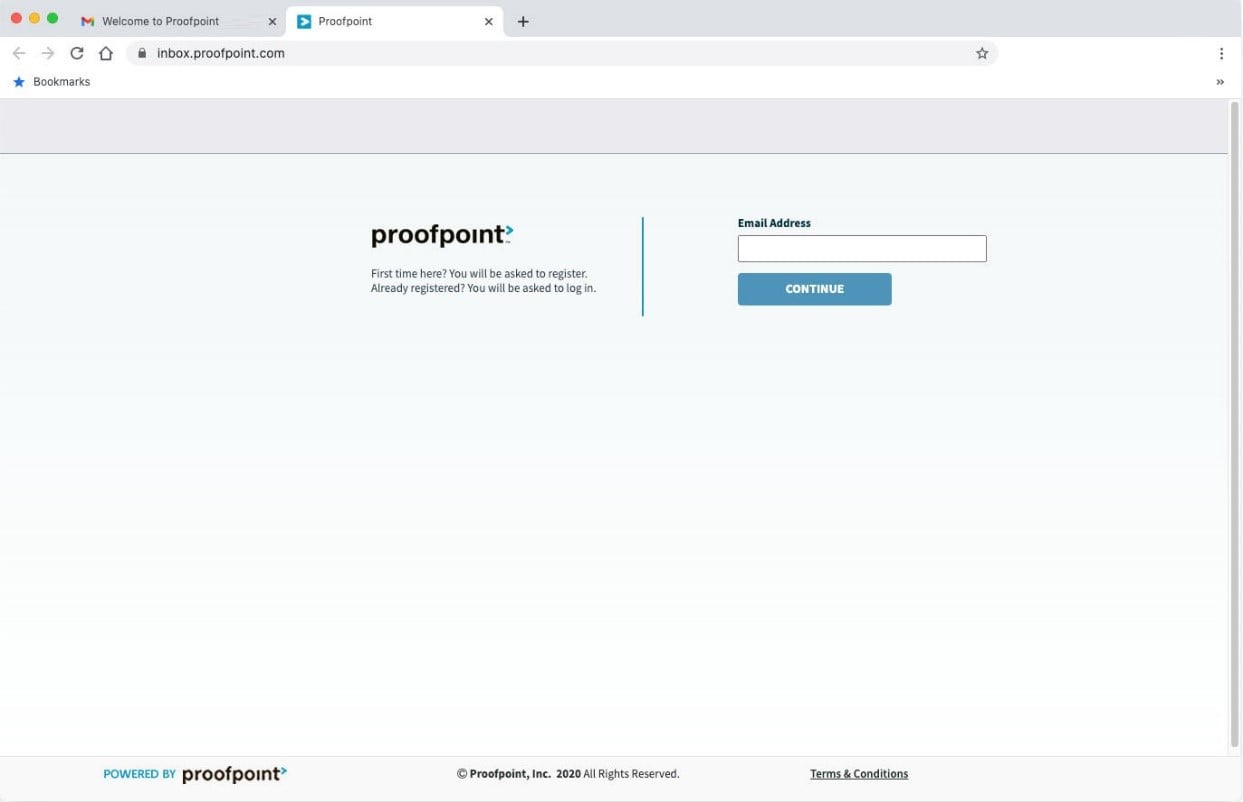

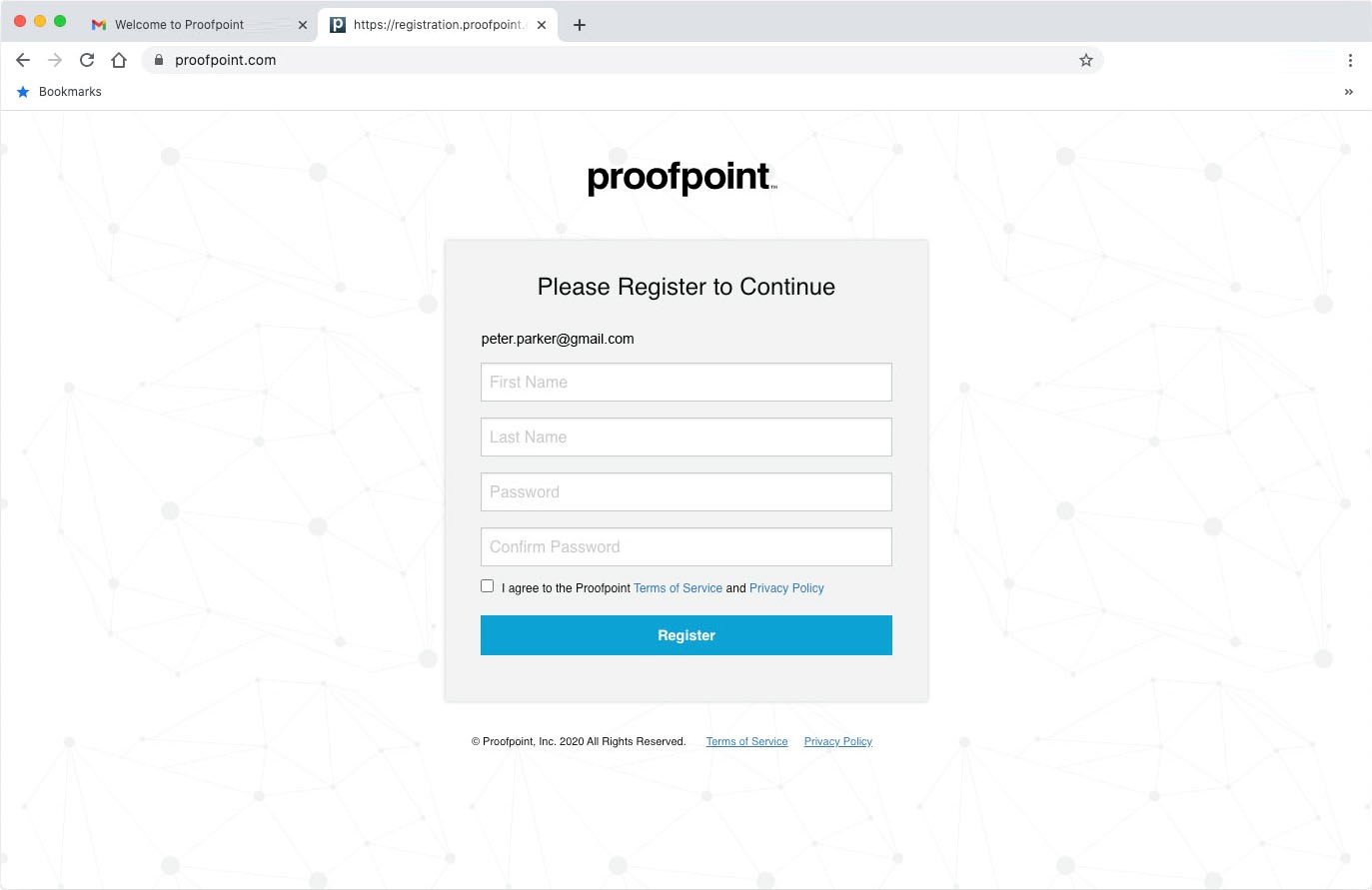

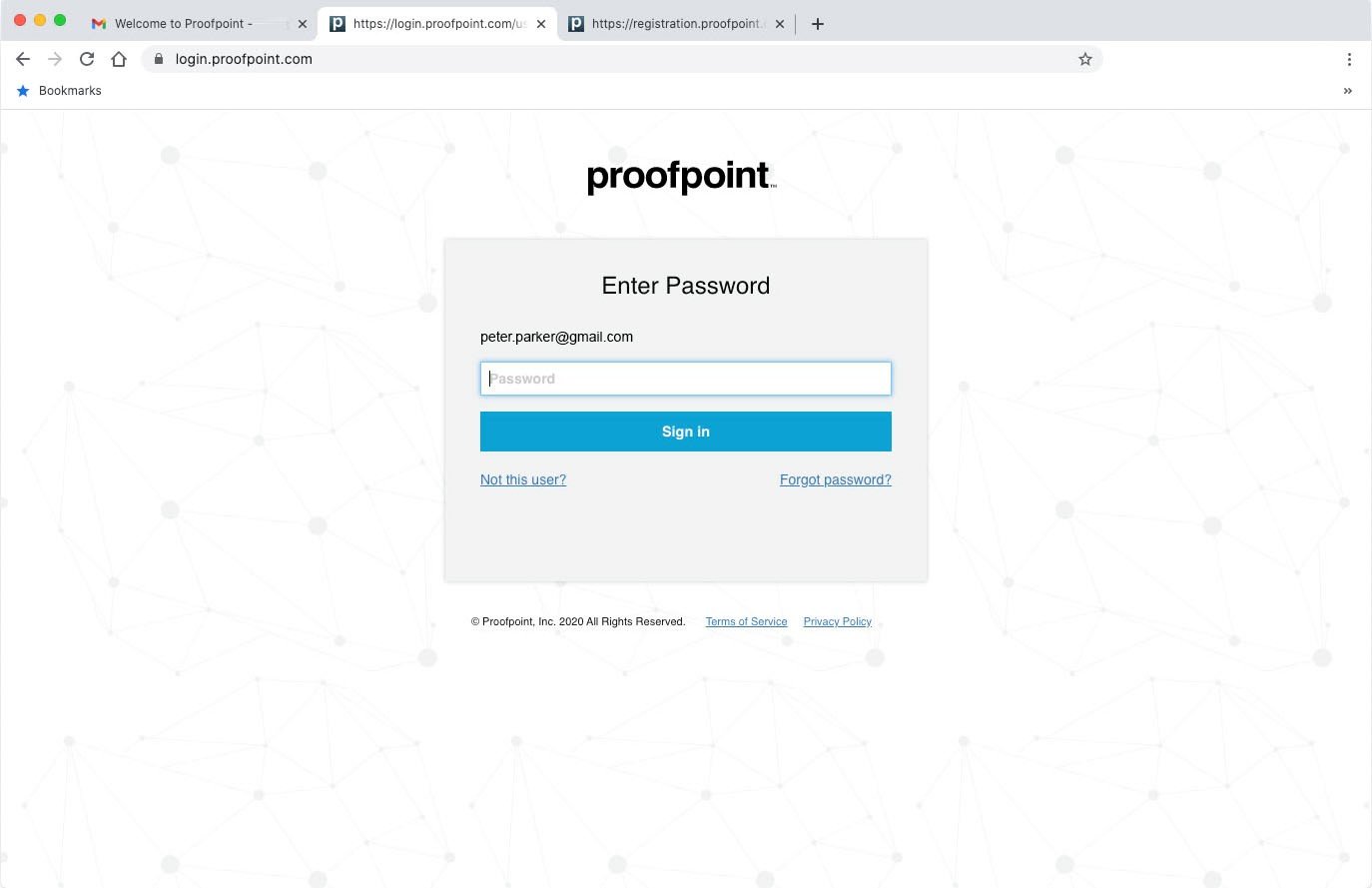

How do I access my secure email?

To sign in to your secure email for the first time, please follow the below steps.

After clicking ‘View Encrypted Email,’ you will be directed to Proofpoint website.

Enter the same email address where you received the Proofpoint email.

Click ‘CONTINUE’

Then you will need to register with proofpoint.

Enter your name, password, check the ‘I agree’ box and then ‘Register’

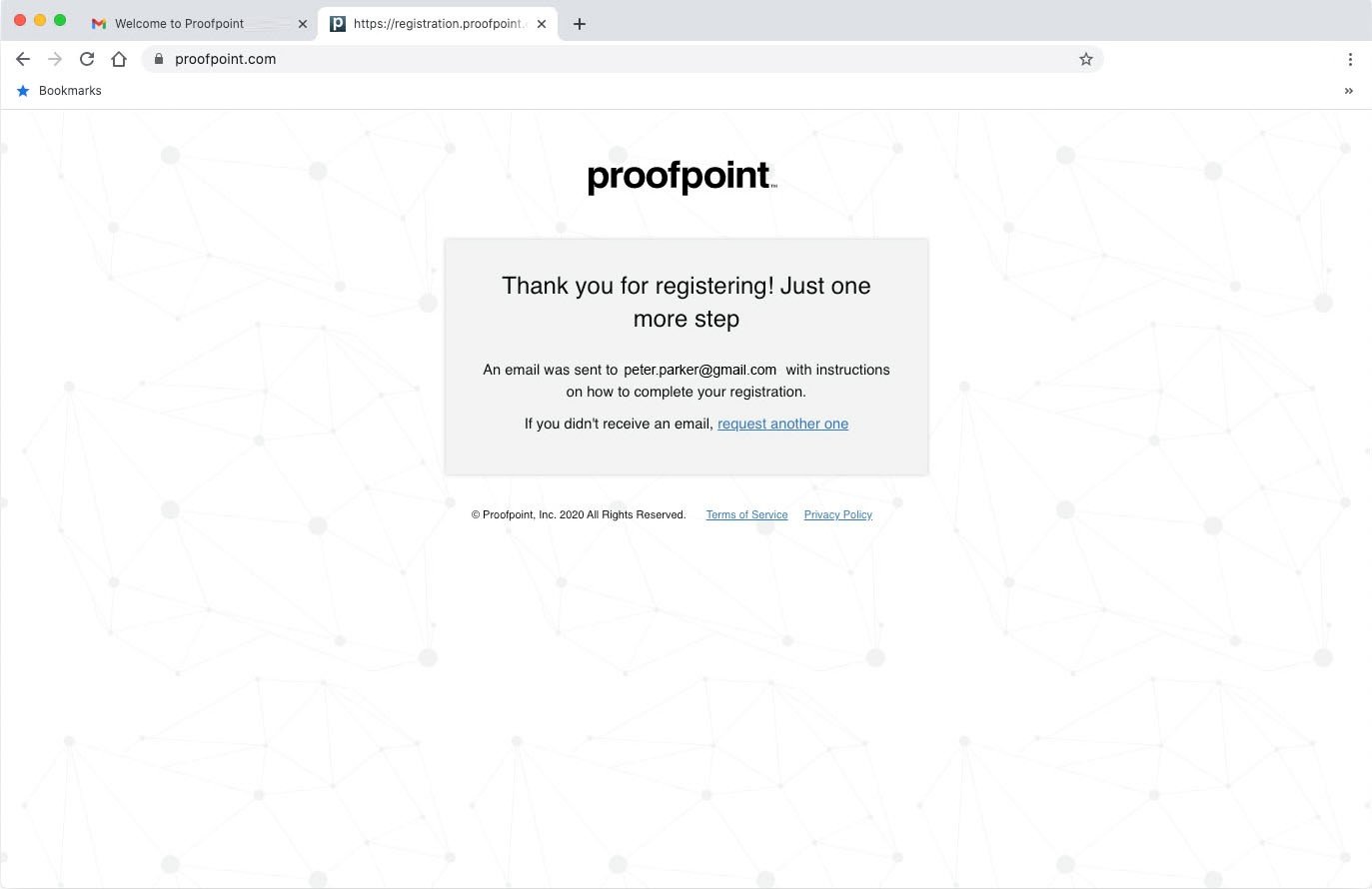

After registering, Proofpoint will send you an email to complete your registration.

Proofpoint sends you this email after you complete the registration form.

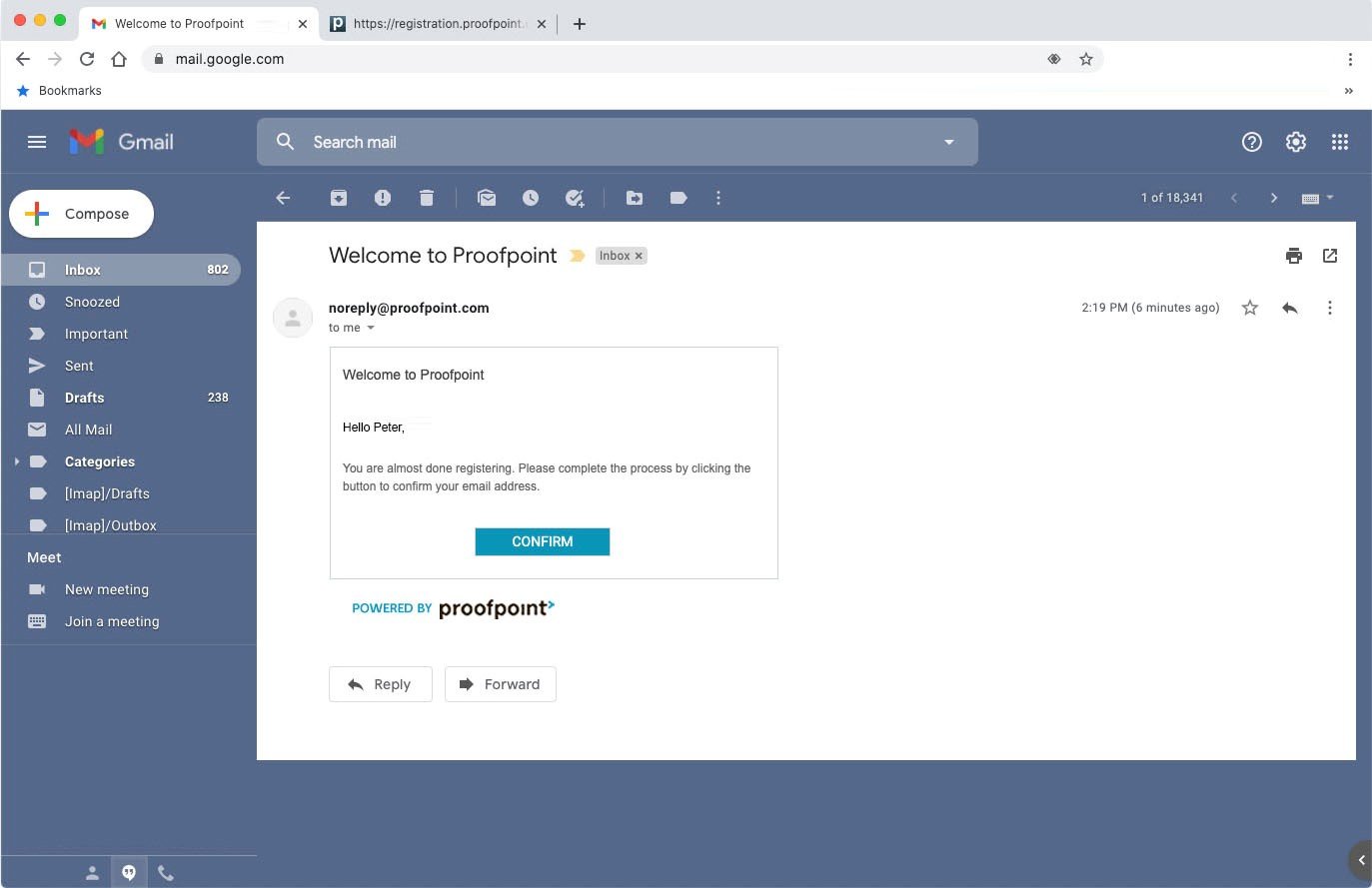

Click on the ‘Confirm’ button to continue.

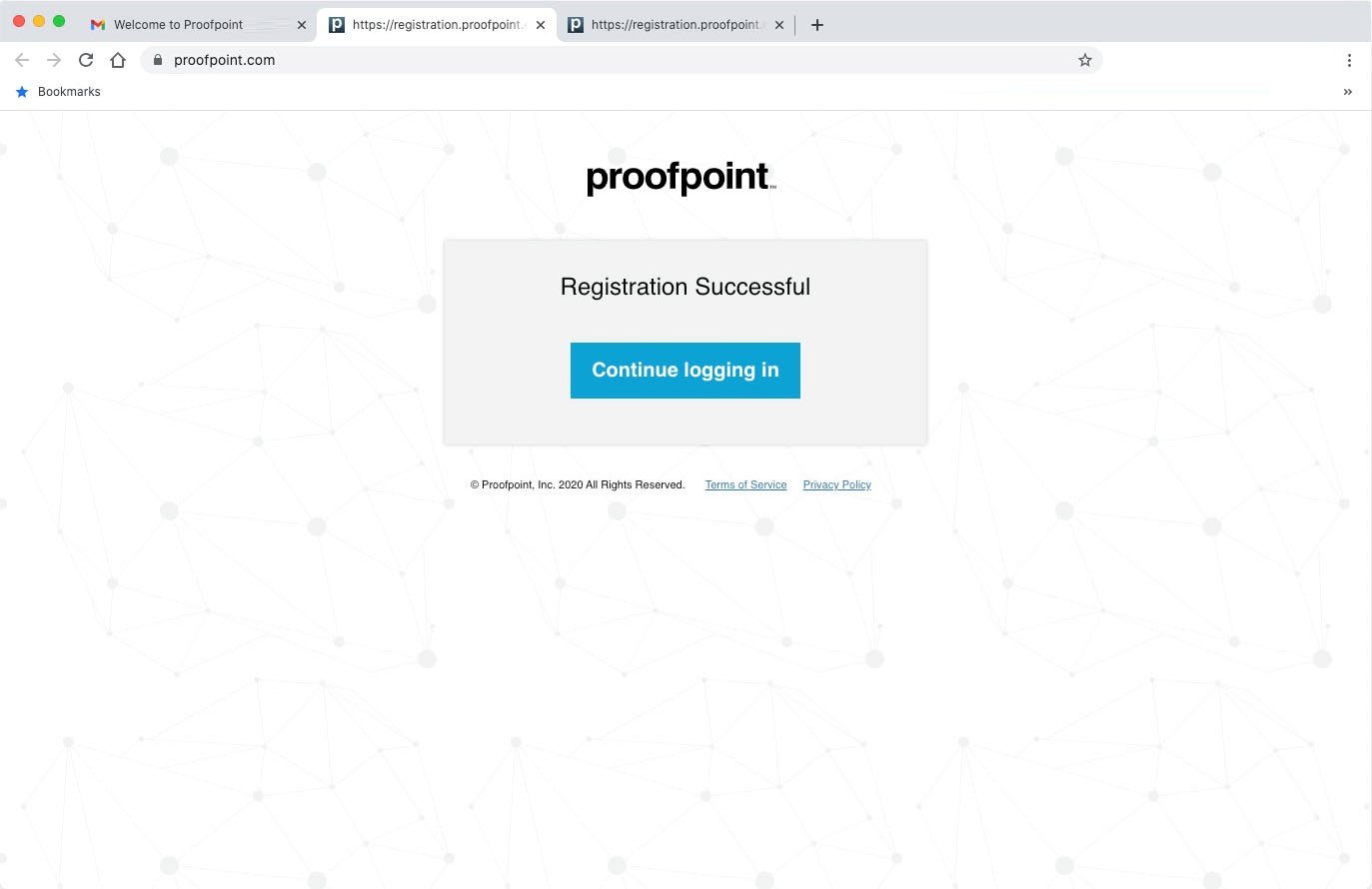

After clicking ‘Confirm’, you will be directed back to the Proofpoint website telling you your registration was successful.

Click ‘Continue logging in’

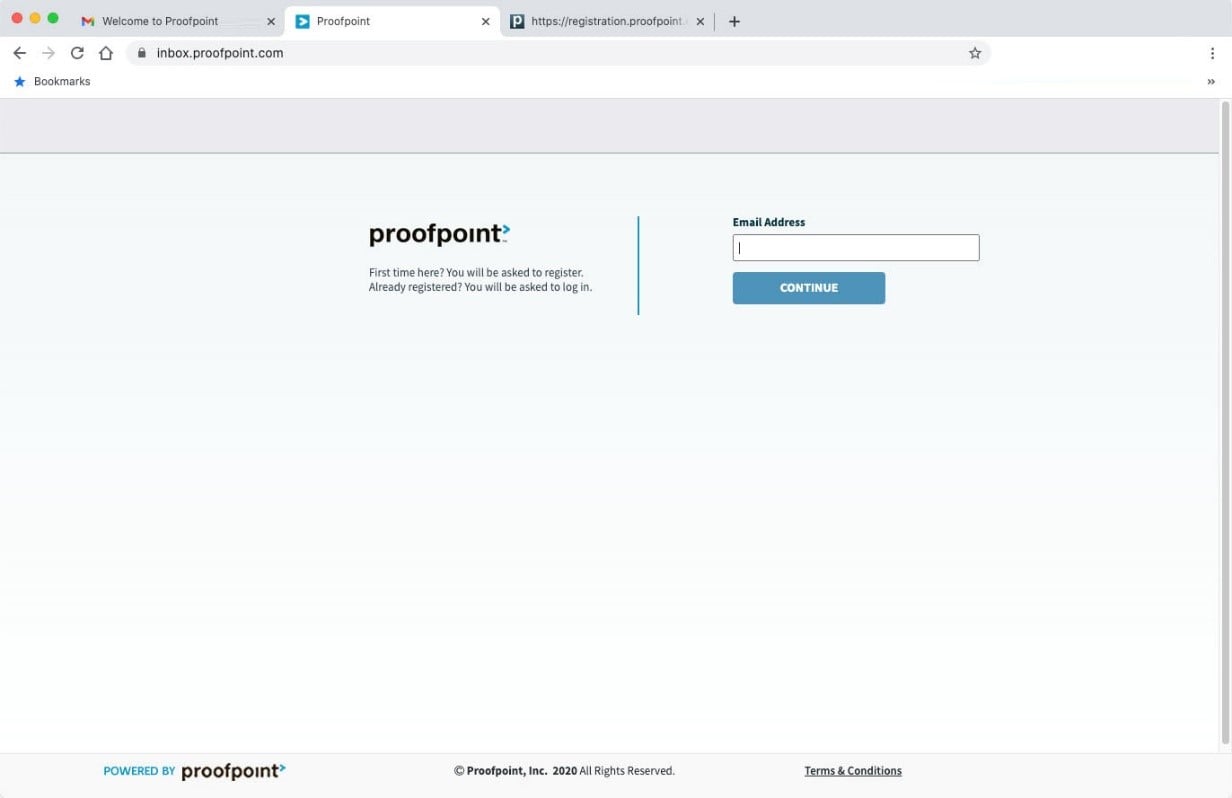

You will then enter the email you used to register and click ‘CONTINUE’

After entering your email, enter the password you created during proofpoint registration and click ‘Sign in’

After successfully signing in, you will see the secure Quontic email.

Scroll down to the bottom (if your browser is not tall enough), and you will see the secure message.

Which wireless carriers are supported?

All major US wireless phone carriers are supported.

How much does Text Banking cost?

There is currently no charge associated with the service. However, there may be charges associated with text messaging and data usage on your device. Check with your wireless provider for more information.

Is Mobile Banking secure?

Yes, our Mobile Banking service utilizes best practices such as HTTPS, 128-bit SSL encryption, device profiling, biometric or password access, and application time-out when your mobile device is not in use.

Do Pay Ring transactions count towards my interest or rewards earned?

Yes, transactions using the Pay Ring do count towards the interest or rewards you earn just like debit card transactions.

How much can I spend using the Ring at a contactless retailer?

The same daily limits for your debit card apply to the Ring.

I tried to use my ring at a terminal and received, “card reader error,” what should I do?

Be sure that the terminal accepts contactless payments. Sometimes, you may need to try to tap the ring a few times before the terminal gets a good read. There may be instances where a terminal is unable to accept the Ring as a payment device – just like some contactless terminals can’t read a debit card and ask that you use chip instead. We always recommend you bring a second method of payment, like your Quontic Bank Debit Card, in case there is a terminal read error.

What if my Ring is lost or stolen?

To address a lost or stolen ring, please promptly review your recent transactions using the Online Banking platform or Mobile App to verify that there are no unauthorized transactions.

For further assistance, kindly contact our Customer Service team via the Message Center accessible through your Online Banking platform (Settings -> Message Center) or by phone at 800-908-6600.

Does Quontic offer Business Accounts?

At this time, Quontic does not offer any business accounts.

How do I open a Certificate of Deposit (CD)?

You can securely open your new CD account online in less than 3 minutes by visiting https://www.quontic.com/certificates-of-deposit.

How do I open a Certificate of Deposit (CD)?

You can securely open your new CD account online in less than 3 minutes by visiting https://www.quontic.com/certificates-of-deposit.

Does Quontic have any branch locations?

No, Quontic operates as a national, digital bank which allows us to pass on the overheard cost savings from operating an expensive network of branches on to our customers in the form of lower fees, better rates or higher rewards.

How do I fund my Certificate of Deposit (CD)?

How do I fund my Certificate of Deposit (CD)?

Is Mobile Banking supported on my device?

Mobile Banking is supported on most devices with a mobile web browser that supports cookies. In addition, the mobile application is available on iPhone and Android smartphones and on iPad and Android tablets. Both mobile web and mobile applications may be found by entering the Mobile Banking URL in your device’s browser.

How do I download my Mobile Banking application?

For iPhone or iPad:

- Navigate to the App Store

- Search for Quontic Bank

- Select “Get” to download the application

For Android:

- Navigate to the Google Play Store

- Search for Quontic Bank

- Select “Install” to download the application

For Kindle Fire:

- Navigate to the Amazon Appstore and select Kindle Fire Apps

- Search for Quontic Bank

- Select “Install” to download the application

Is Mobile Banking supported on my tablet?

The same mobile app that runs on your phone will run on your tablet.

How do I endorse my check for mobile deposit?

You should sign your check with the following endorsement:

- For mobile deposit at Quontic Bank only

- Your account number

- Your signature

How do I get started with a non-traditional loan?

The first step to getting pre-qualified for a non-traditional loan is to Speak To a Quontic Mortgage Expert.

How do I get started with a non-traditional loan?

The first step to getting pre-qualified for a non-traditional loan is to Speak To a Quontic Mortgage Expert.

Are gift funds accepted for a non-traditional loan?

Yes, Quontic accepts 100% Gift Funds for down payment and closing costs for eligible applicants.

Are gift funds accepted for a non-traditional loan?

Yes, Quontic accepts 100% Gift Funds for down payment and closing costs for eligible applicants.

Do I need tax returns to qualify for a non-traditional loan?

No tax returns or W2s are needed to qualify for our Non-Traditional Loans.

Do I need tax returns to qualify for a non-traditional loan?

No tax returns or W2s are needed to qualify for our Non-Traditional Loans.

How much of a down payment do I need for a non-traditional loan?

Depending on which loan program you qualify for, you can have as little as a 20% down payment to own a home.

How much of a down payment do I need for a non-traditional loan?

Depending on which loan program you qualify for, you can have as little as a 20% down payment to own a home.

Do I need to verify my income for a non-traditional loan?

Depending on which loan program you qualify for, a statement of income may not be required.

Do I need to verify my income for a non-traditional loan?

Depending on which loan program you qualify for, a statement of income may not be required.

What do I need to open a Certificate of Deposit (CD)?

When you open a Certificate of Deposit, we will ask for your name, address, date of birth, social security number to allow us to identify you. We may also ask for a valid government-issued ID. There is a minimum of $500 to open. You must be a U.S. Citizen and 18 years or older to open an account.

What do I need to open a Certificate of Deposit (CD)?

When you open a Certificate of Deposit, we will ask for your name, address, date of birth, social security number to allow us to identify you. We may also ask for a valid government-issued ID. There is a minimum of $500 to open. You must be a U.S. Citizen and 18 years or older to open an account.

Is there a maximum amount I can deposit into a Certificate of Deposit (CD)?

The maximum deposit to open a CD is $1,000,000.

Is there a maximum amount I can deposit into a Certificate of Deposit (CD)?

The maximum deposit to open a CD is $1,000,000.

How do I open a High Interest Checking account with Quontic?

You can securely open your new High Interest Checking account online in less than 3 minutes by visiting https://www.quontic.com/high-interest-checking/.

How do I open a High Interest Checking account with Quontic?

You can securely open your new High Interest Checking account online in less than 3 minutes by visiting https://www.quontic.com/high-interest-checking/.

What is Quontic’s overdraft policy?

Quontic does not charge an overdraft fee. View Quontic’s fees here.

What is Quontic’s overdraft policy?

Quontic does not charge an overdraft fee. View Quontic’s fees here.

Does Quontic offer IRAs?

At this time, Quontic does not offer any retirement accounts, including IRAs.

What do I need to open a checking account?

When you open an account, to validate your identify we will ask for:

- your name

- address

- date of birth

- social security number

We may also ask for a valid U.S. government-issued ID. There is a minimum required amount to open an account. You will fund your account via online transfer from an account you have at another bank (during the online account opening process).

Please Note: You must be a U.S. Citizen and 18 years or older to open an account.

What do I need to open a checking account?

When you open an account, to validate your identify we will ask for:

- your name

- address

- date of birth

- social security number

We may also ask for a valid U.S. government-issued ID. There is a minimum required amount to open an account. You will fund your account via online transfer from an account you have at another bank (during the online account opening process).

Please Note: You must be a U.S. Citizen and 18 years or older to open an account.

Who is eligible for Mobile Remote Deposit Capture (RDC)?

Customers who have a High Interest Checking account, Cash Rewards Checking account, High Yield Savings account, or Quontic Money Market account are eligible for Mobile RDC service.

Who is eligible for Mobile Remote Deposit Capture (RDC)?

Customers who have a High Interest Checking account, Cash Rewards Checking account, High Yield Savings account, or Quontic Money Market account are eligible for Mobile RDC service.

Can I take money out of a savings account?

Yes!

Can I take money out of a savings account?

Yes!

What does the interest rate mean?

The interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed.

What does the interest rate mean?

The interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed.

How is my personal information used?

Your information is used to identify you. It is securely stored in your account and customer records once your new account is opened. Federal law requires that all financial institutions obtain, verify, and record personal information that identifies each person who opens an account.

How is my personal information used?

Your information is used to identify you. It is securely stored in your account and customer records once your new account is opened. Federal law requires that all financial institutions obtain, verify, and record personal information that identifies each person who opens an account.

How can I speed up my application?

If you already have an account with us, and return to open a new account, your information will populate based off the first application.

How can I speed up my application?

If you already have an account with us, and return to open a new account, your information will populate based off the first application.

What is Quontic’s routing number?

Quontic’s routing number is 021473030.

What is the difference between Quontic’s High Yield Savings account and Money Market account?

| Money Market | High Yield Savings | |

|---|---|---|

| Product Description | The Money Market account is a savings account that offers a debit card and check-writing privileges. | A high-yield savings account allows our customers to earn higher interest than a regular savings account. |

| Current APY |

For current APY’s, view our Rate Sheet. |

|

| Minimum Deposit | $100.00 | $100.00 |

| ATM Access | Yes, customers can request a Debit Card | Yes, customers can request an ATM card |

| Check Writing | Yes, Options | Checks are not an option for our savings account |

| Fees | No Monthly or Overdraft fees *Other fees may apply |

No Monthly or Overdraft fees *Other fees may apply |

| FDIC Insurance | Available on eligible accounts | Available on eligible accounts |

| Zelle | Yes | Not available for HYS |

| Quontic Ring | Yes, customer can order a Quontic Ring | Not available for HYS |

| Mobile Deposit | Yes | Yes |

| Bill Pay | Yes | Not available for HYS |