High Yield Savings

PERCENTAGE YIELD1

- Apply in 3 minutes or less

- No monthly service fees

- $100 minimum opening deposit

- Interest compounded daily

- FDIC insured to the maximum legal limits

Raise the bar with 3.75% APY

Frequently Asked Questions

How is my interest calculated?

Interest is compounded daily based on your posted account balance.

When is interest paid?

How do I fund my account?

To make your initial deposit, you can transfer money from your existing Quontic account, you can transfer money from an external account via ACH, or using Plaid’s technology. Please ensure that you have sufficient funds available to be transferred.

Is there a minimum opening deposit?

What you get

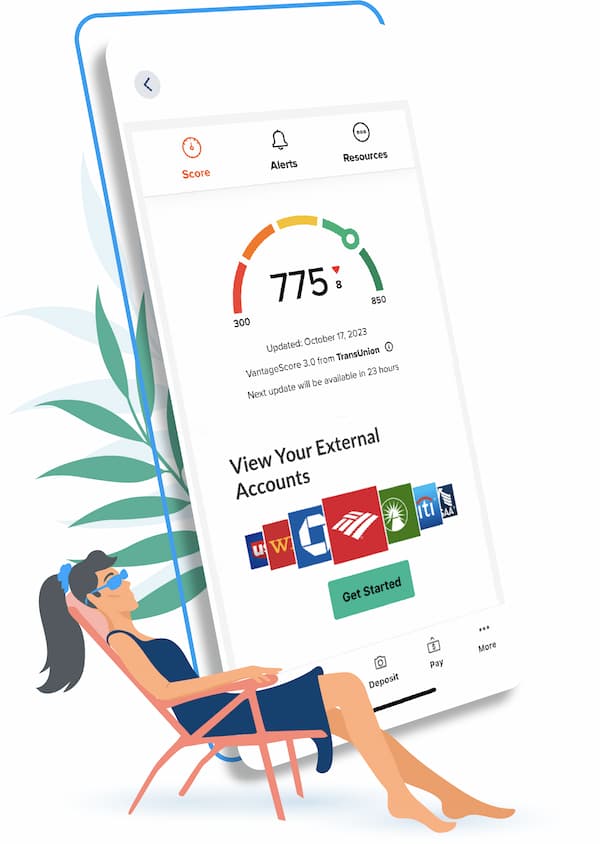

Financial Tools

Track your spending and monitor credit with a full credit report, and credit monitoring.

Banking should be easy

- Send & Receive

Remote check deposit, bill pay, and account transfers. Make and receive payments to your contacts. - Synced Accounts

A birds-eye view of all your bank accounts, and loans in one place. - Biometric Authentication

Log in to your account securely with your fingerprint or facial recognition.

Support when you need it, and how you want it

Banking with a purpose

Disclaimer:

1High Yield Savings Account – $100 to open account. Rates may change without notice. If the account is closed before interest and/or bonus is credited, accrued interest and/or bonus may be forfeited for that statement cycle. Fees could reduce earnings. Ask for details. Additional terms, conditions, fees & exclusions may apply. Information is as of December 20, 2024.

2 National Average APY information as of March 26, 2025, according to the FDIC National Rates and Rate Caps.