6 Month CD

4.45%

Annual Percentage Yield1

Are you wanting to grow your savings, but don’t want to tie up your funds for a long period of time? Quontic’s 6 Month Certificate of Deposit may be the right savings option for you. Open your account in 3 minutes or less.

- No monthly service fee

- FDIC insured to the maximum legal limits3

- Minimum $500 deposit required

See how much your money could grow with Quontic

$0

Interest Earned

National Average

$0

Interest Earned

Frequently asked questions

How do I open a Certificate of Deposit (CD)?

Is there a minimum to open a Certificate of Deposit?

The minimum deposit is $500.

How do I fund my Certificate of Deposit (CD)?

How is my interest calculated?

Interest is compounded daily and credited to your account monthly. Interest is calculated using the daily balance method. This method applies a daily periodic rate to the principal and interest that has accrued in the account each day.

When is interest paid?

You will start earning interest the business day we receive your opening deposit. Interest will be paid once per monthly statement period.

What happens when my CD matures?

Will I receive a confirmation when my CD automatically renews?

Yes, you will receive a confirmation when your CD automatically renews. The confirmation will be sent out after the 10-day grace period concludes.

What fees or penalties are associated with my CD?

The applicable early withdrawal penalties are as follows:

You may not make a partial withdrawal of principal. You cannot withdraw principal from this account prior to the maturity date without our consent. If we consent to the redemption of the certificate of deposit prior to the maturity date, we will close the certificate deposit and impose an early withdrawal penalty. For time deposits up to 12 months, the penalty will be equal to the interest for the full length of the stated term. For time deposits 12 months to under 24 months, the penalty equals one year interest. For time deposits 24 months and over, the penalty equals two years interest. If the accrued interest exceeds the penalty amount, the excess accrued interest over the penalty amount will be paid to you. If the accrued interest is less than the penalty amount, a reduction of the principal balance may result.

Can I add additional funds to a CD once it's been opened?

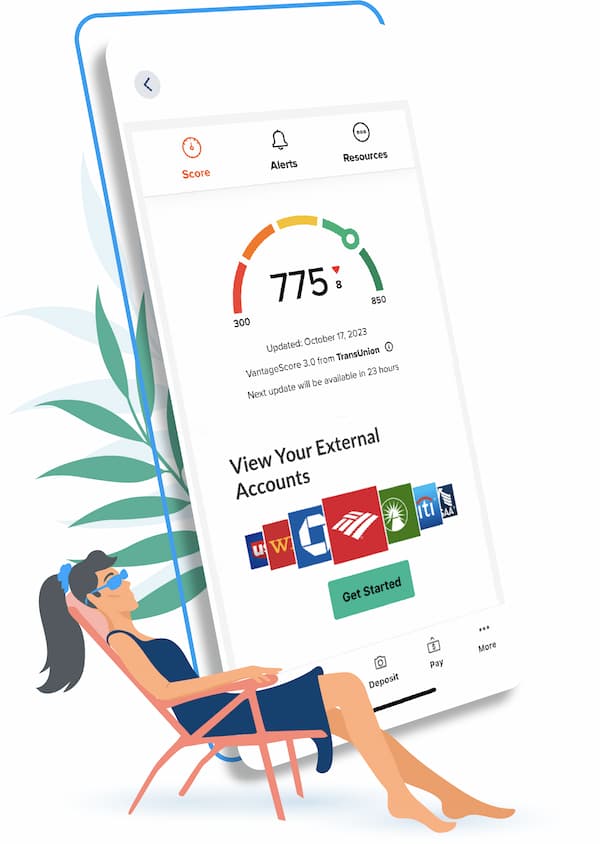

Banking should be easy

- Financial Tools

Track your spending and monitor credit with a full credit report, and credit monitoring. - Synced Accounts

A birds-eye view of all your bank accounts, and loans in one place. - Biometric Authentication

Log in to your account securely with your fingerprint or facial recognition.

Support when you need it, and how you want it

Banking with a purpose

Disclaimer:

Ask for details. Additional terms, conditions, fees & exclusions may apply. If the account is closed before interest and/or bonus is credited, accrued interest and/or bonus may be forfeited for that statement cycle. Fees could reduce earnings. In order to sign up for online banking, you must have a Quontic Bank account. Mobile banking requires enrollment through online banking. Data connection required. Wireless carrier fees may apply. There is no charge from Quontic Bank for account alerts, but message & data rates may apply. Mobile check deposit is available for select mobile devices. Subject to eligibility & further review. Deposits are subject to verification & not available for immediate withdrawal. Deposit limits & other restrictions may apply.

Online Account Opening is only available to consumers. Ask for details. Data connection required to open an account online. Wireless carrier fees may apply. Application is subject to approval & further review. Information is accurate as of the date listed below and may change without notice.

1Certificate of Deposit. Minimum $500 to open account. Withdrawals before the maturity date are subject to penalties. Fees could reduce earnings. Additional terms, conditions, fees & exclusions may apply. Annual Percentage Yield (APY) and information is accurate and effective as of October 24, 2024. Subject to change without notice.

2National Average APY information as of October 24, 2024, according to the FDIC National Rates and Rate Caps.

Apply for your Certificate of Deposit Now! Get started Get started

Apply for your Certificate of Deposit Now! Get started Get started