Convenience

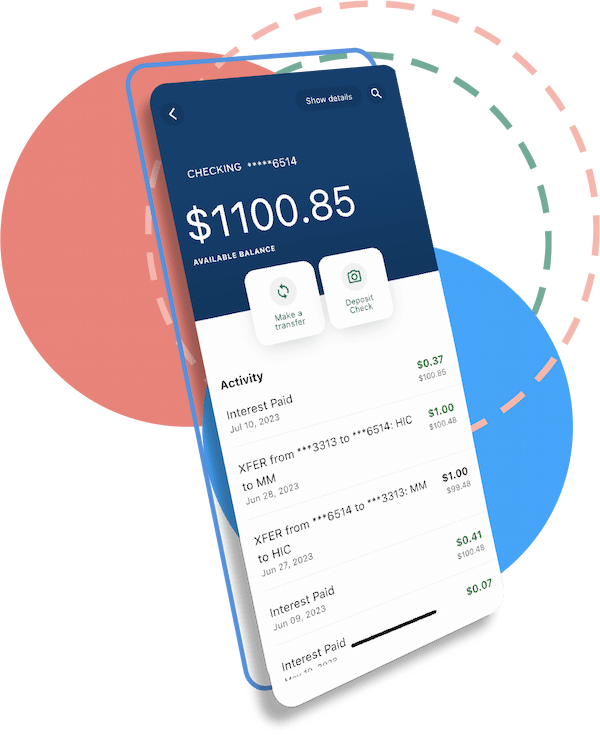

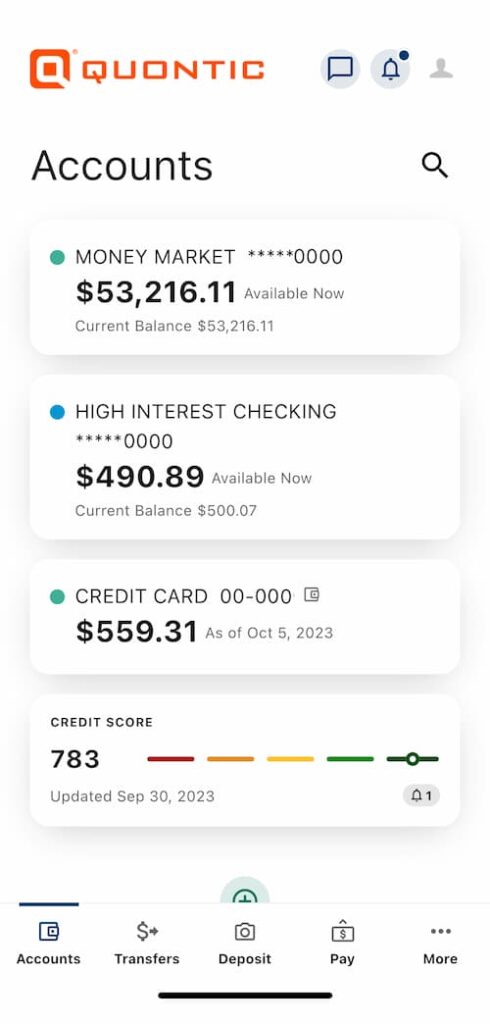

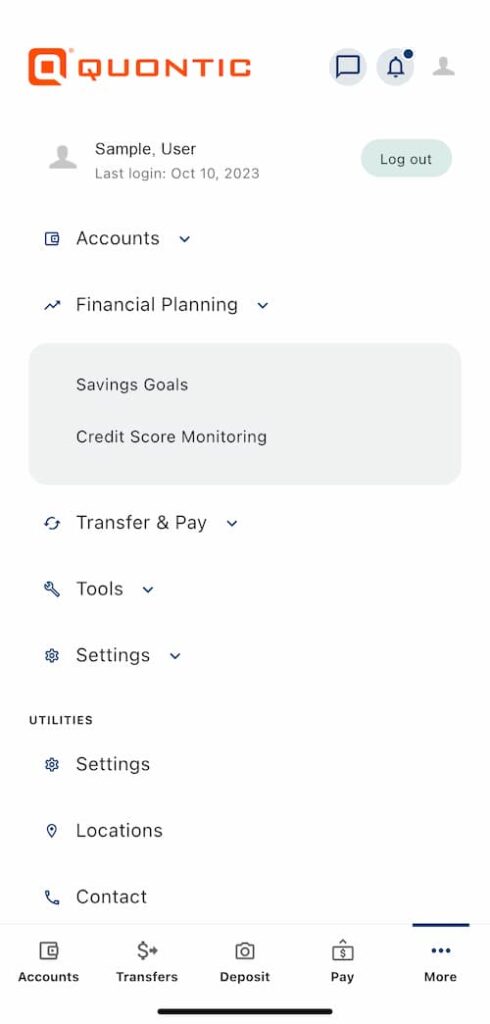

Account Management

Move Money

Schedule or pay bills, make transfers between your accounts, or use Zelle to exchange money with friends and family.

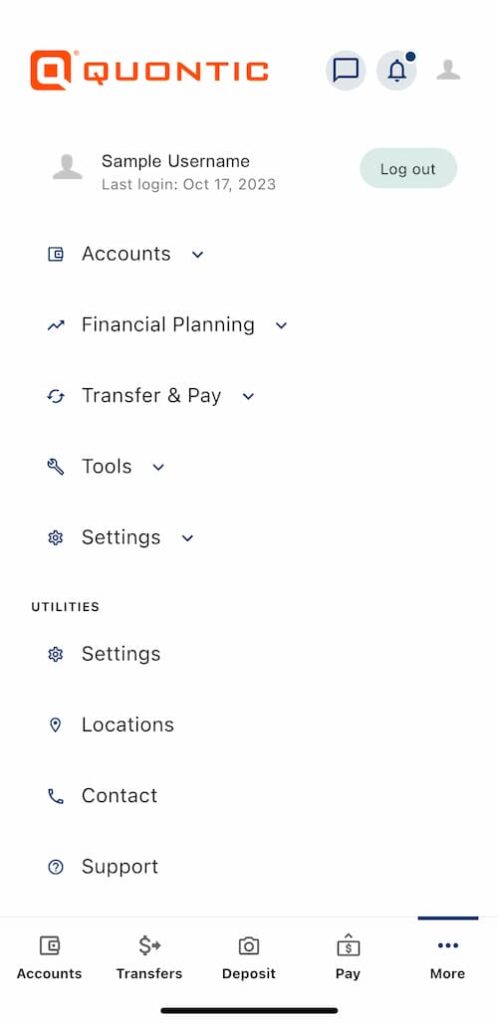

Support

when you need it, and how you want it

Frequently asked questions

How do I access the new experience Online and Mobile Banking experience starting November 7th?

- Tap the App Store app to open it.

- Next, tap on your profile icon at the top.

- Scroll down to the Available Updates section.

- Locate the Quontic app and tap Update.

Is Mobile Banking secure?

What is Zelle®?

Zelle® is a fast, safe, and easy way to send money directly between almost any bank accounts in the U.S. – typically within minutes*. With just an email address or U.S. mobile phone number, you can send money to people you know and trust, regardless of where they bank*. Ask your recipient to enroll with Zelle® before you send them money – this will help them get your payment more quickly.

*A U.S. checking or savings account is required to use Zelle®. Transactions between enrolled consumers typically occur in minutes and generally do not incur transaction fees.

Which wireless carriers are supported?

All major US wireless phone carriers are supported.

Will an alert be sent to me even if I am not logged in to Online or Mobile Banking?

Yes, as long as you have enabled Card Alerts you will receive a push notification.