High Interest Checking

No pockets no problem

With the Quontic Pay Ring, always have access

to your money with this payment wearable.

Leave your debit card behind and embrace

the future of payments.

How it works

How it works

1. Open a High Interest Checking Account

Apply online in 3 minutes or less with no impact on your credit score. Fund your new account with a minimum balance of $100.

2. Make the required transaction per statement cycle

Use your debit card to make at least 10 qualifying point of sale transactions of $10 or more.

Interest is compounded daily and deposited into your account each month based on your account daily balance and satisfying the point of sale eligible transactions requirements per statement cycle.

Frequently asked questions

What do I need to get started?

Is there a minimum to open an Account?

Can I take money out of the account?

Are there ATM Fees?

What you get

Banking should be easy

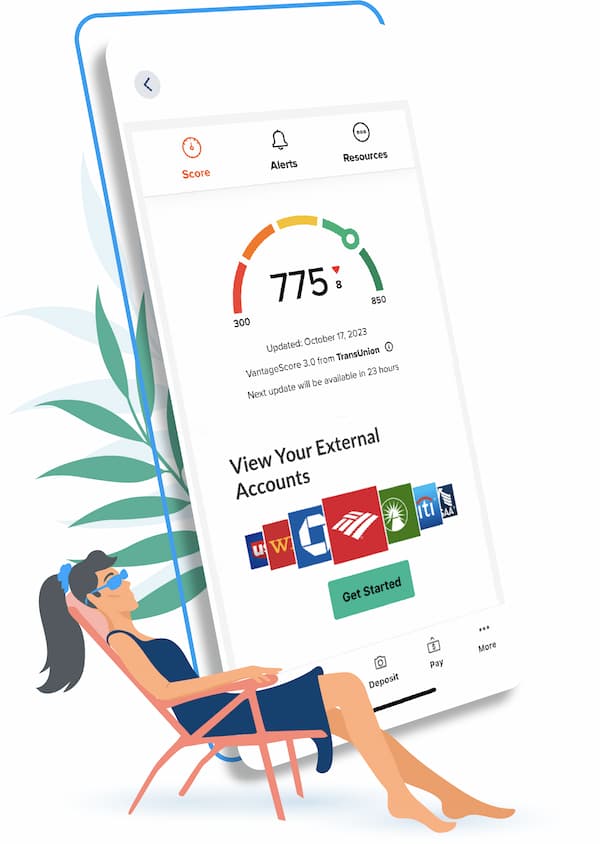

- Send & Receive

Remote check deposit, bill pay, and account transfers. Make and receive payments to your contacts. - Financial Tools

Track your spending and monitor credit with a full credit report, and credit report monitoring. - Synced Accounts

A birds-eye view of all your bank accounts, and loans in one place. - Biometric Authentication

Log in to your account securely with your fingerprint or facial recognition.

Support when you need it, and how you want it

Banking with a purpose

Disclaimer:

1High Interest Checking Account is a conditional tiered variable rate account wherein you must deposit $100.00 to open this account. After fulfilling the minimum qualifying activity requirements per statement cycle of 10 qualifying Point of Sale debit card transactions equal to or over $10.00 per transaction, the 1.10% annual percentage yield (APY) applies to all balance tiers, which are identified as $0–$150,000, $150,000.01–$1,000,000 and balances over $1,000,000. If the qualifying activity requirement is NOT fulfilled, the annual percentage yield on the balance will be 0.01%. Ask for details. Additional terms, conditions, fees & exclusions may apply. Rates may change without notice. If the account is closed before interest and/or bonus is credited, accrued interest and/or bonus may be forfeited for that statement cycle. Fees could reduce earnings. The following activities are not considered qualifying POS debit card transactions and do not count toward earning rewards: ATM- processed transactions; transfers between accounts; purchases made with debit cards not issued by our bank; cash over portions of point-of-sale transactions; Peer-to-Peer (P2P) payments (such as Apple Pay Cash*); loan payments or account funding made with your debit card and purchases made using third-party payment accounts. Transactions may take one or more business days from the date the transaction was made to post and settle to an account. Online Account Opening is only available to consumers. Data connection required to open an account online. Carrier fees may apply. Application is subject to approval. Information is accurate as of August 15, 2024 and may change without notice.

2FDIC insurance is applicable to eligible deposit accounts and up to the maximum allowed by law. Learn more at FDIC: Deposit Insurance

Target is a trademark of Target Brands, Inc. Speedway is a trademark of Speedway LLC. Walgreens is a trademark of Walgreen Co. CVS is a trademark of CVS Pharmacy, Inc. Kroger is a trademark of The Kroger Co. of Michigan. Safeway is a trademark of Safeway Inc. Winn Dixie is a trademark of Winn-Dixie Stores, Inc. Circle K is a trademark of Circle K Stores Inc.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. ©2018 Google LLC, used with permission. Google Pay and the Google Pay logo are trademarks of Google LLC. The Samsung Pay® logo is a registered trademark of Samsung Electronics Co., Ltd. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Mastercard is a registered trademark of Mastercard International Incorporated.

Bankrate is a registered trademark of Bankrate, LLC. Forbes is a registered trademark of Forbes LLC. SmartAsset is a registered trademark of Financial Insight Technology, Inc. NerdWallet is a registered trademark of NerdWallet, Inc.