Cash Rewards Checking

GET 1.00% CASH BACK ON ALL

ELIGIBLE DEBIT CARD PURCHASES1

Use your Quontic Debit Card for everyday purchases and earn cash back each month! Minimum opening deposit of $100.

How easy it is

How easy it is

1. Open a Cash Rewards Checking Account

Open your online account in 3 minutes or less.

2. Use your Quontic debit card

Qualifying point of sale (POS) debit card transactions1 that post and settle to the account each statement cycle shall receive 1.00% cash back. Ask for details. Additional terms, conditions, fees & exclusions may apply.

3. Receive 1.00% cash back each month

Frequently Asked Questions

What do I need to get started?

Our secure account opening process takes less than 3 minutes from start to finish! We ask for a few pieces of information like basic contact info, your social security number, and DOB. You will then be able to fund your account instantly!

Is there a minimum to open a Cash Rewards Checking Account?

You can open an account with as little as $100.

How do I fund my Account?

To make your initial deposit, you can transfer money from your existing Quontic account, you can transfer money from an external account via ACH, or using Plaid’s technology. Please ensure that you have sufficient funds available to be transferred.

How do I get cash back?

When do I get my reward?

Your cash back reward will be paid and deposited into your checking account at the beginning of each new statement cycle.

Are there ATM Fees?

You won’t have to pay ATM fees when you use your Quontic Debit Card at any AllPoint® Network ATMs, MoneyPass® Network ATMs, SUM® program ATMs, or Citibank® ATMs located in Target, Speedway, Walgreens, CVS, Kroger, Safeway, Winn Dixie, and Circle K.

Can I take money out of my account?

Yes, you can spend your money like any other checking account. You will be able to sign up for Online Banking, Mobile Banking and be provided with a Quontic Debit Card.

Can I add money to my account?

Yes! You can easily add money to your account through remote check deposit via our convenient Mobile App, by setting up direct deposit from your work, by mailing a check, depositing money via ACH, or by wire.

What you get

Banking should be easy

- Send & Receive

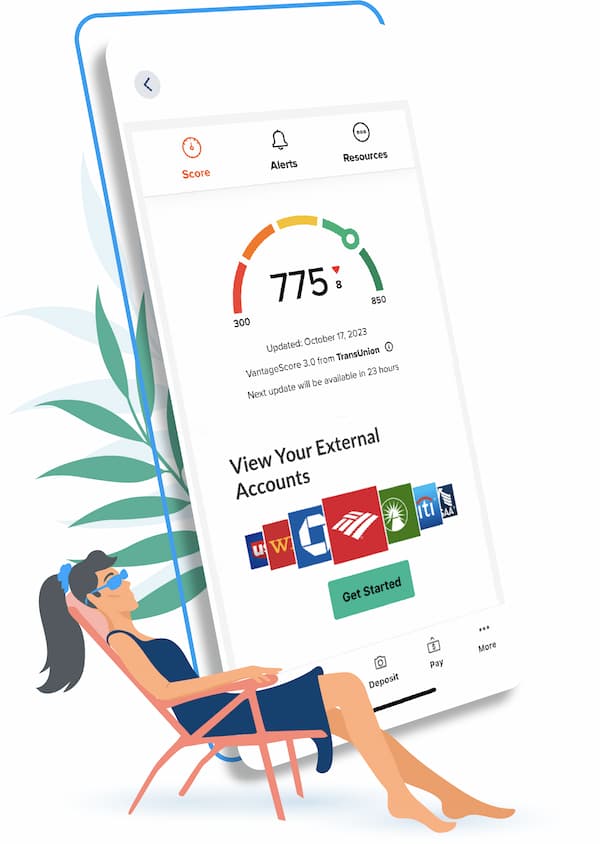

Remote check deposit, bill pay, and account transfers. Make and receive payments to your contacts. - Financial Tools

Track your spending and monitor credit with a full credit report, and credit report monitoring. - Synced Accounts

A birds-eye view of all your bank accounts, and loans in one place. - Biometric Authentication

Log in to your account securely with your fingerprint or facial recognition.

Support when you need it, and how you want it

Banking with a purpose

Disclaimer:

Ask for details. Additional terms, conditions, fees & exclusions may apply. Rates may change without notice. Some accounts may require a minimum average daily balance for the statement cycle to avoid service charges. If the account is closed before interest and/or bonus is credited, accrued interest and/or bonus may be forfeited for that statement cycle. Fees could reduce earnings. In order to sign up for online banking, you must have a Quontic Bank account. Mobile banking requires enrollment through online banking. Data connection required. Wireless carrier fees may apply. There is no charge from Quontic bank for account alerts, but message & data rates may apply. mobile check deposit is available for select mobile devices. Subject to eligibility & further review. Deposits are subject to verification & not available for immediate withdrawal. Deposit limits & other restrictions may apply.

2FDIC insurance is applicable to eligible deposit accounts and up to the maximum allowed by law. Learn more at FDIC: Deposit Insurance

Target is a trademark of Target Brands, Inc. Speedway is a trademark of Speedway LLC. Walgreens is a trademark of Walgreen Co. CVS is a trademark of CVS Pharmacy, Inc. Kroger is a trademark of The Kroger Co. of Michigan. Safeway is a trademark of Safeway Inc. Winn Dixie is a trademark of Winn-Dixie Stores, Inc. Circle K is a trademark of Circle K Stores Inc.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. ©2018 Google LLC, used with permission. Google Pay and the Google Pay logo are trademarks of Google LLC. The Samsung Pay® logo is a registered trademark of Samsung Electronics Co., Ltd. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Mastercard is a registered trademark of Mastercard International Incorporated.

Open your checking account in 3 minutes or less! Open an account Open an account

Open your checking account in 3 minutes or less! Open an account Open an account